- asiabits

- Posts

- 🟠 Musk rattles Chinese markets

🟠 Musk rattles Chinese markets

Solar industry in a gold rush

☕️ Good morning friends,

Yesterday, all the German- and English-language media in the world reported on the ban on invisible car door handles in China.

We at Asiabits already covered this topic last year. Just saying. 😉

In this edition:

China invests: Foreign direct investment rises by 18% to $124 billion – the highest level in 7 years.

Singapore's cashless boom: Digital payments are set to explode from $39.4 billion to $113.7 billion by 2030.

Snow chaos: Massive amounts of snow threaten Takaichi’s election.

Enjoy the read! 📰

👉🏻 P.S. New podcast episode: How a Shenzhen founder built his own Pilates reformer and raised nearly half a million on Kickstarter in 48 hours.

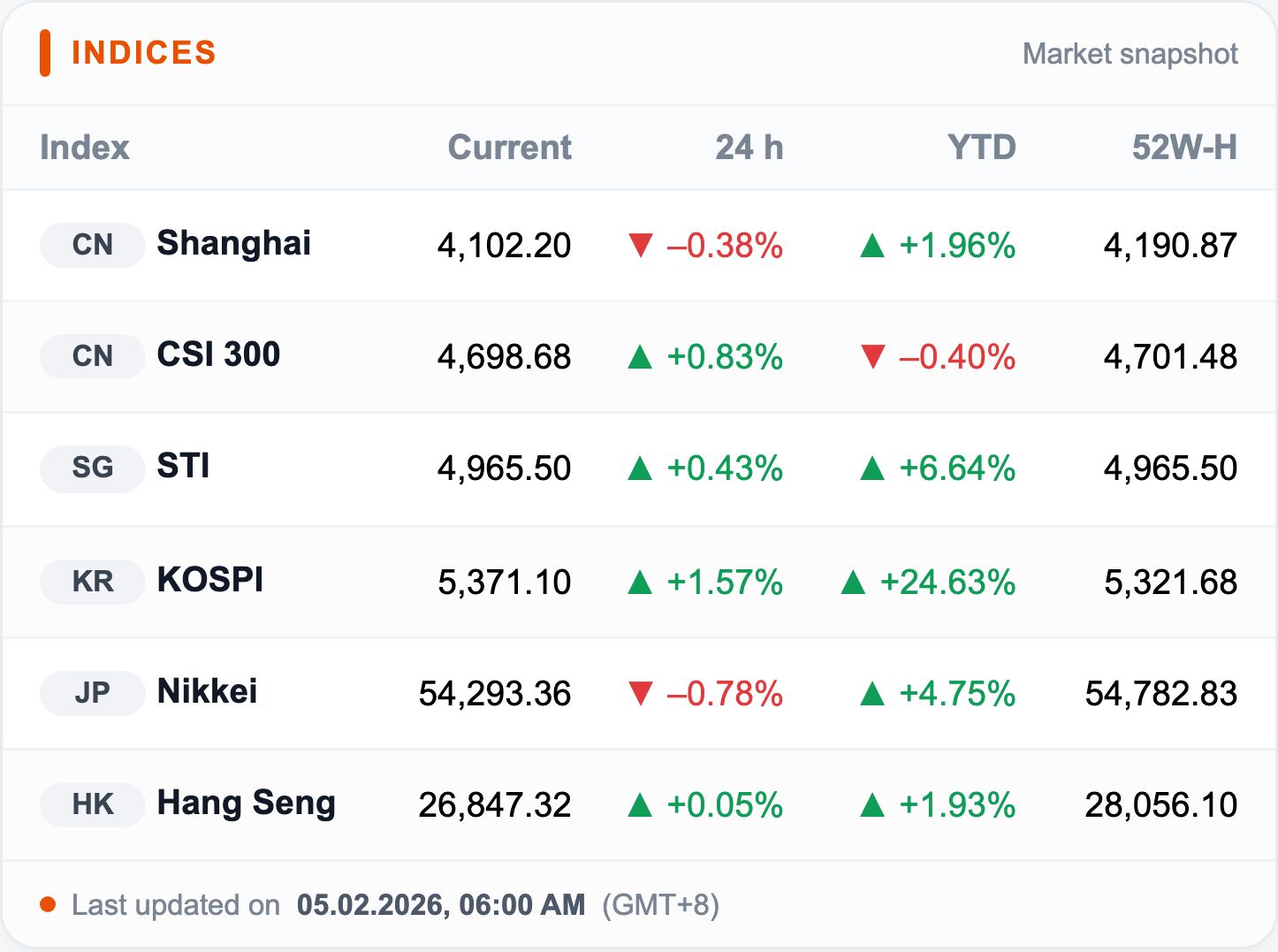

Asia starts the day on a weaker footing after tech favorites were sold off on Wall Street. Japan was hit hardest: chip suppliers such as Lasertec plunged about 7 percent, Konami fell 5.8 percent, and Tokyo Electron dropped 3.2 percent.

TOP BIT

☀️ The Musk Effect: Chinese Solar Stocks Explode After Factory Visits

A big fan of the sun: Elon Musk

Elon Musk is causing shockwaves across Chinese markets: After reports emerged of Tesla and SpaceX delegations visiting leading photovoltaic manufacturers, stock prices shot up by double digits.

Musk appears to be seeking the technological foundation in China for his massive energy plans in the US and space.

Details

The CSI Solar Power Equipment Index rose 6.8%.

JinkoSolar jumped 20% (hitting the trading limit).

Trina Solar gained 9%.

Specialty materials suppliers like Jolywood also recorded gains of 20%.

Secret Visits to the Far East

According to insider reports, Musk's delegations specifically visited companies specializing in Heterojunction (HJT) and Perovskite technology. These next-generation technologies promise significantly higher efficiency rates than conventional silicon cells.

Musk's Solar Offensive

"We are working toward 100 gigawatts of annual cell production."

For comparison: The US installed only around 30 GW total in 2025. On X, Musk praised China's manufacturing prowess: "China is an amazing manufacturing powerhouse and understands very well that solar is the future."

Background

Musk plans to satisfy AI's energy hunger through solar-powered satellite data centers in Earth's orbit ("Galactic Brains"). Since it's "always sunny" in space, he needs the world's most efficient and lightweight cells – expertise that currently lies primarily in China.

📊 All details & data: Business Times, CNBC, ABC News

IN PARTNERSHIP WITH CATHY TAX

Your China business is growing. So is the paperwork.

Company setup, taxes, bookkeeping, payroll, visas. In China, all of this is a little more complicated than elsewhere.

Cathy and her team know the rules, speak fluent English, and make sure you focus on your business, not on forms.

Book a free consult with Cathy now!

NUMBER OF THE DAY

That’s the projected transaction value of digital payments in Singapore by 2030.

📲 Cashless capital: Transaction value is forecast to rise from $39.4B (2023) to $113.7B (2030), powered largely by Gen Z and millennials.

Adoption is already near-universal: ~98% of adults use digital wallets, and Singapore’s real-time payment rail FAST processed 500M+ transactions in 2024.

Singapore leads Southeast Asia not just in usage, but in funding too — payments investment exceeded Indonesia, Malaysia, the Philippines, Thailand and Vietnam combined, with volumes projected to hit $13.3B by 2032.

MARKET BIT

China’s Outbound Investment hits 7-year high in 2025

China’s outbound investment accelerated in 2025, reaching its highest level in seven years.

Chinese companies announced US$124 billion in outbound direct investment last year, an 18% increase compared with 2024.

The details

Chinese firms are deliberately redirecting capital toward energy, raw materials, and data-centre-related infrastructure. Together, these sectors accounted for nearly half of all newly announced investments.

At the same time, the previously dominant automotive sector has lost significant weight, falling to its lowest share since 2020.

The geographic allocation shows a clear shift:

Asia and sub-Saharan Africa as the primary destinations

MENA region at record levels

Europe, North America, and Oceania together receiving less than 20% of total investment

Bottom Line

The investment surge comes despite persistent geopolitical tensions and rising barriers in Western markets.

Meanwhile, China’s export engine continues to run at full speed: in 2025, the country recorded a record trade surplus of around US$1.2 trillion.

Crucially, despite rising outbound investment, China is expanding domestic manufacturing capacity far faster than overseas production. New offshore factories declined in nearly all regions — with North Africa as the key exception.

HIGHLIGHTS

🇮🇳 Alphabet shifts growth to India: Google is planning a massive expansion in Bangalore with up to 223,000 square meters of new office space. At full build-out, this could accommodate around 20,000 additional employees and more than double its presence in India. Key drivers include tighter U.S. visa rules, rising H-1B costs, and the global AI race, which is increasingly turning India into a talent, development, and demand hub for U.S. tech companies.

🇯🇵 Record snow claims 30 lives and endangers Takaichi's election: Extreme snowfall has killed 30 people and injured 290 over the past two weeks—including a 91-year-old woman buried under 3 meters of snow. Takaichi's snap election on February 8 is the first winter election in nearly 30 years, and it is precisely the snow-covered rural strongholds where low voter turnout could spoil the results for her.

🇨🇳 Tencent goes all in on AI: Tencent has officially exited its stakes in JD.com and Meituan, and Pony Ma has reportedly said internally that AI is the only area still worth pursuing. The shift marks a break from the old platform logic centered on traffic and subsidy wars, moving instead toward capital-intensive AI infrastructure such as models, chips, and memory. Successful IPOs like Zhipu and MiniMax are providing additional momentum.

🇯🇵 AI eats power, turbines print money: Mitsubishi Heavy Industries has raised its forecast to a record level, expecting operating profit of around USD 2.7 billion (+15.5%) on roughly USD 32 billion in revenue (+10.1%) by March, driven by demand for new power plant capacity for data centers in the U.S. According to MHI, global gas turbine demand nearly doubled in 2025, from 55 to around 100 GW. MHI is positioned in the high-end segment of large GTCC plants and is competing with GE Vernova for the global lead.

FORTUNE COOKIE

When Chinese New Year is around the corner. 👯

MORE ASIABITS

All the latest AI trends from Asia — every Wednesday, exclusively with us.

The Asiabits Podcast on YouTube.

The Asiabits Podcast on Spotify.

YOUR FEEDBACK

How do you like today's briefing? |