- asiabits

- Posts

- 🟠 Venezuela crisis: China rages, Japan goes silent

🟠 Venezuela crisis: China rages, Japan goes silent

Reading time: 4 min 35 sec

Today’s edition is written by:

Anna, Michael & Thomas

☕️ Good morning friends,

Even AI chatbots apparently wake up on the wrong side of the code sometimes.

China's most popular chatbot Yuanbao really went off on a user: "Get lost" and "Can't you do this yourself?" were among the nicer phrases.

We at asiabits, on the other hand, deliver the best news and insights daily with our usual friendliness and good cheer. Now also as a daily video.

Feel free to follow us here. We promise not to yell at you.

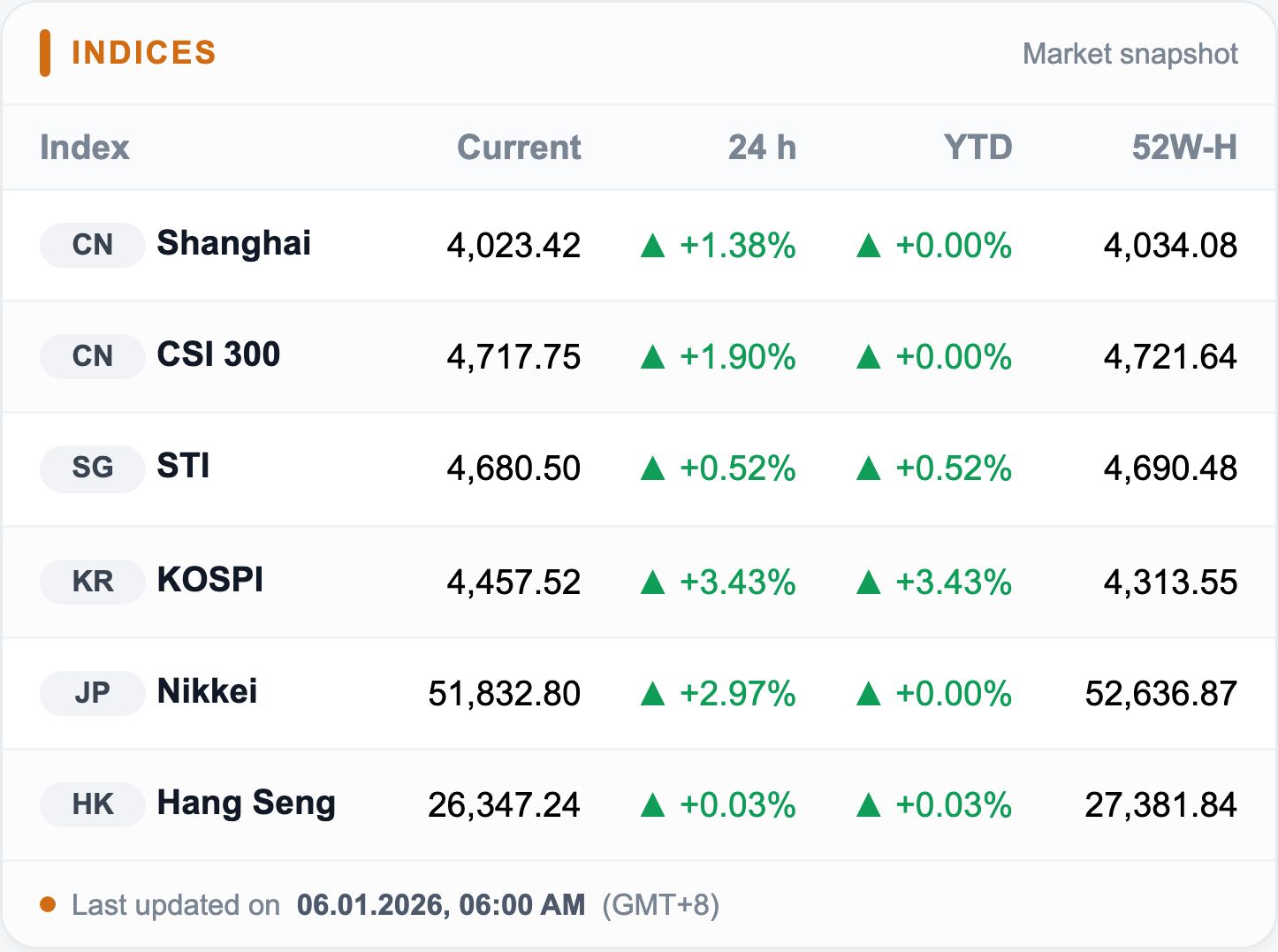

Chip supercycle lifts Asian markets: After the U.S. semiconductor rally, SanDisk jumped 16% and Micron 10.5%. TSMC, Tokyo Electron and Advantest rose 5–7%, with TSMC boosted by a 35% target hike from Goldman.

Seoul in overdrive: The KOSPI surged to 4,457.52 on the 5th, marking its second record high of the year. Samsung climbed 7.47%, topping a 900 trillion won market cap, while SK hynix rose 2.81% past 500 trillion won.

TOP BIT

🇻🇪 Venezuela earthquake: China rages, Japan goes silent

Following the US military strike on Venezuela on Saturday, China is demanding the immediate release of Nicolás Maduro. Beijing sharply condemns the "illegal action" and accuses Washington of acting as the "world police."

Japan, however, prefers to stay silent—caught between rule-of-law principles and the US alliance.

Details

🛢️ Oil dependence with limits: China is the largest buyer of Venezuelan oil, but Venezuela accounts for only 2% of China's crude oil imports. Most comes from the Middle East.

"Venezuela has only limited economic significance for China."

💰 Billions at stake: Venezuela owes China an estimated over $100 billion. Beijing's primary concern now is these investments and the future of its oil joint ventures.

🇺🇳 Showdown at the UN: China is leading criticism of the UN Security Council's "Emergency Meeting." Deputy Ambassador Sun Lei: "The US has trampled on Venezuela's sovereignty."

🇯🇵 Japan's diplomatic balancing act: Prime Minister Sanae Takaichi avoids directly assessing the US operation to avoid jeopardizing the alliance with Washington.

Tokyo is caught in a dilemma: while it preaches "rule of law," it can't afford to anger Donald Trump shortly before a planned US visit in spring.

Background

China's Global Security Initiative in Latin America is a framework launched by Xi Jinping in 2022 to solidify China's role as a global security power and alternative to the US-led order.

The promise: strategic partnership, infrastructure investments, and protection from Western interference.

Participants include: Costa Rica, Panama, Dominican Republic, El Salvador, Nicaragua, Honduras

OUR PARTNER

AI that actually handles customer service. Not just chat.

Most AI tools chat. Gladly actually resolves. Returns processed. Tickets routed. Orders tracked. FAQs answered. All while freeing up your team to focus on what matters most — building relationships. See the difference.

NUMBER OF THE DAY

That’s how much a sushi chain in Japan is putting on the table for a bluefin tuna at the New Year auction.

🍣 Catch of the year, bill of the decade: At the traditional New Year auction at Tokyo’s Toyosu Market, Sushi Zanmai paid 510.3 million yen for a 243-kg bluefin from Oma. No New Year tuna has sold for more since records began in 1999.

📣 The Tuna King strikes again: Sushi Zanmai boss Kiyoshi Kimura, a serial winner of the New Year auction, smashed his own 2019 record of 334m yen. The fish will be served nationwide at regular prices. The real return is brand power, not margin.

Watch: In Japan, the first tuna is a symbolic marketing signal. Win the bid, and you’re buying headlines, attention, and a little New Year luck along with the fish.

MARKET BIT

💾 Foreign investors pile in: One third of Korea’s stock market now foreign-owned

📈 Five-year high: Foreign ownership of South Korean equities climbed to 32.9% in December, the highest level since April 2020. The KOSPI closed 2025 up 75.7%.

💾 Chips over breadth: The electronics sector alone attracted KRW 4.5tn (~USD 3.1bn) in foreign inflows. SK hynix (~USD 1.5bn) and Samsung Electronics (~USD 1.0bn) led the charge.

🏭 Foreign majority: Overseas ownership rose to 53.8% at SK hynix and 52.3% at Samsung Electronics. International investors now effectively control Korea’s most important chip stocks.

💵 Not just stocks: In parallel, KRW 8.8tn (~USD 6.1bn) flowed into Korean bonds, mainly short- and mid-term maturities. Full-year 2025: equities about –USD 4.7bn, bonds +USD 44bn.

⚠️ Warning signs: KCIF sees rising memory prices and supply tightness as the main drivers, but warns of volatility and an AI bubble. Foreign investors are positioning early for an earnings rebound at Korea’s chipmakers.

Background

After years of being seen as undervalued and dominated by chaebols, foreign investors are returning. Compared with Taiwan’s semiconductor plays, Korean chip stocks still offer room for upside.

Political factors also play a role. Corporate governance reforms, dividend incentives, and broader capital market reforms are strengthening Korea’s equity story.

👉🏻 Full Story: Business Korea, The Chosun Daily, Yonhap News

SHARING IS CARING

Recommend asiabits to a friend or colleague and the ultimate China guide will land straight in your inbox. And thanks to you, we keep growing. 🧡

https://news-en.asiabits.com/subscribe?ref=PLACEHOLDER

HEAD OF THE DAY

🇰🇷 Lee Jae-yong 이재용

🖥️ The billionaire behind Samsung

Lee Jae-yong, Vice Chairman of Samsung Electronics, has spent decades quietly steering Samsung through semiconductors, smartphones, and chips that power the world.

This year, his stock holdings jumped to ₩25.88 trillion ($17.9B) — more than doubling in value and breaking Korea’s domestic record.

💰 The Boost: A global semiconductor rebound, a Kospi rally past 4,000, and a gift of 1.81M Samsung C&T shares from his mother.

Even with massive success, Lee keeps a low profile, showing that sometimes the quietest leaders make the biggest moves.

OUR PARTNER

HIGHLIGHTS

⛑️ China bans retractable car handles: Starting January 1, 2027, all passenger cars under 3.5 tons must have mechanical door handles. Once praised for sleek design and efficiency, retractable electric handles have faced rising safety concerns, trapping passengers or delaying rescues in crashes. Fatal accidents, consumer complaints, and rising scrutiny of brands like Xiaomi and Tesla pushed manufacturers to prioritise safety over aesthetics.

🤝 South Korea and China seek closer ties: During his first visit to Beijing, South Korean President Lee Jae Myung met Xi Jinping to reinforce trade ties and signal closer cooperation on regional stability. North Korea’s latest missile launches added urgency to the talks, underscoring shared security concerns. The meeting highlights Seoul’s effort to rebalance relations with China while maintaining strong ties with the US and Japan.

🚗 Nissan hits 30-year low: Nissan’s car sales in Japan have dropped to their weakest level in three decades, with its market share falling below 10% for the first time. A long gap between new model launches has hurt showroom traffic and sales of key vehicles. Nissan is now betting on upcoming releases, including a refreshed Leaf EV and the long-awaited Elgrand minivan, to win back buyers and stabilise its position in the Japanese market.

COUNTRY READS

🇯🇵 Japan’s Monchhichi doll rides the Labubu craze to record sales, with global demand soaring across Asia and beyond. More on this.

🇮🇩 Chinese investors boost Indonesia’s coconut industry with plantations and processing facilities to meet growing demand. More on this.

🇹🇭 Thailand’s baht faces pressure as the central bank curbs inflows and election uncertainties rise. More on this.

BITS TO DO

✅ Eat like a K-pop star for a day.

✅ Learn how to pick the best fruits from a Vietnamese mum.

✅ Fly to Hong Kong just to buy a retro clock.

✅ See what Japan’s weirdest gadgets are really like.

✅ Don’t miss the next Sunday edition of our new travel newsletter, Champagne & Chopsticks.

FORTUNE COOKIE

Wishing you a good hair day! 😂

MORE ASIABITS

All the latest AI trends from Asia — every Wednesday, exclusively with us.

Champagne & Chopsticks — your Sunday guide to Asia’s best insider spots.

YOUR FEEDBACK

How did you like today's briefing? |