- asiabits

- Posts

- 🟠 Trump is driving South Korea crazy

🟠 Trump is driving South Korea crazy

Reading time: 4 min 33 sec

☕️ Good morning friends,

this Tuesday, Trump is driving everyone crazy again. We are watching the events unfold calmly from the sidelines here in Shanghai and, as always, are providing you with the most important info on the matter.

Also today:

How a Shanghai-based AI company raised an incredible $720 million, and other exciting stories from Japan, South Africa, and a copper mine in Tibet.

Enjoy the read! 📰

👉🏻 Want to know how to get the royals from Abu Dhabi to invest in your company? Then check out our interview with Audrey!

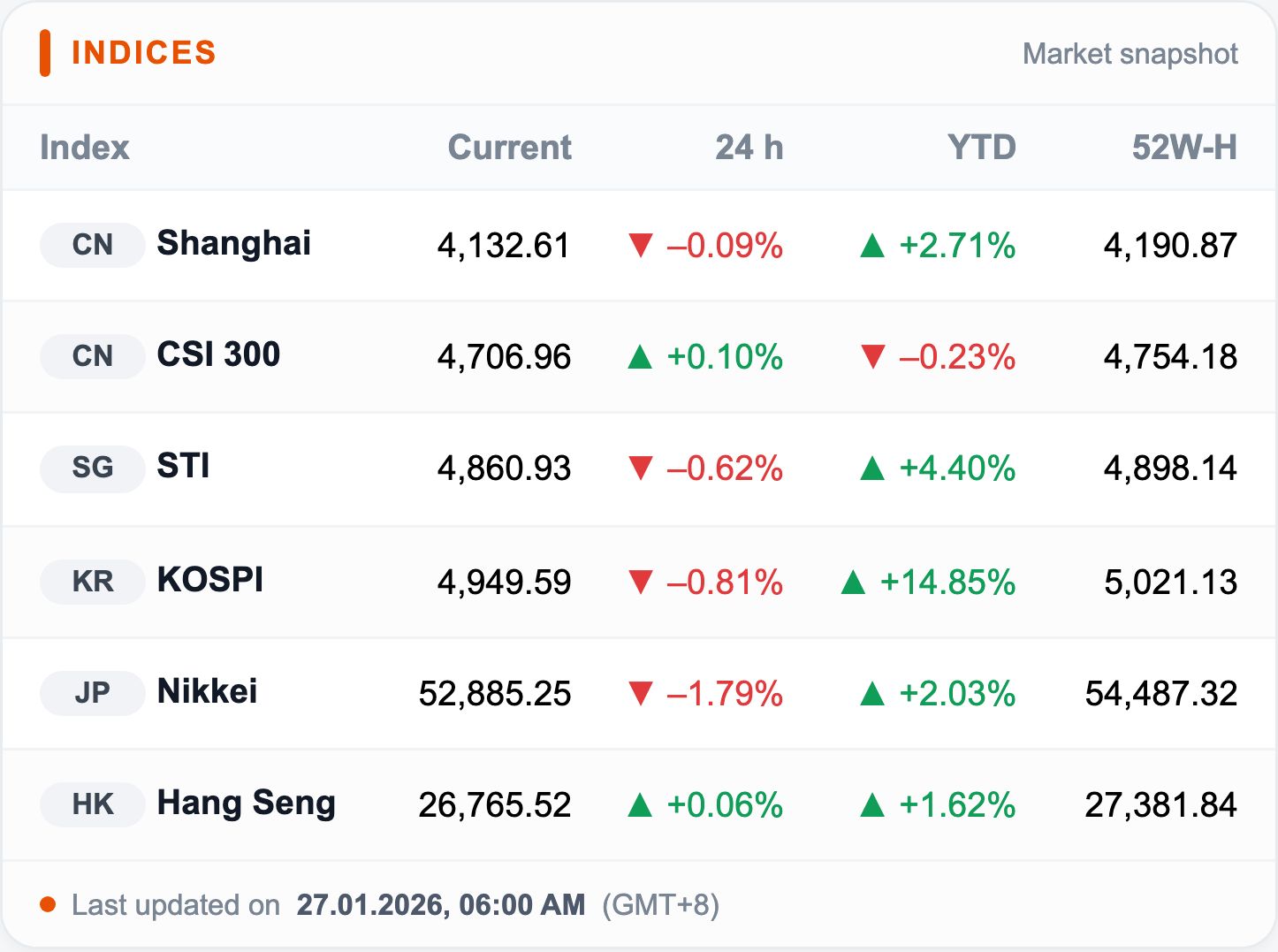

Korea breaks records: South Korea’s tech-heavy secondary index KOSDAQ crossed the 1,000-point mark for the first time in four years, closing at 1,064, up 7%. The rally was so strong it even triggered a temporary trading halt.

Gold above $5,100: A safe-haven rush driven by geopolitical tensions pushed gold to a new all-time high.

TOP BIT

Trump tightens the screws: 25% punitive tariffs on South Korea

Back when the world was still in order…

Donald Trump has increased tariffs on South Korean imports from 15% to 25%—just three months after the celebrated trade agreement. Affected: autos, pharma, timber.

His allegation: South Korea’s parliament is not ratifying the deal fast enough.

Source: Truth Social

Immediately following Trump’s post, there was a market tremor in Seoul: Hyundai shares dropped by 4% and Kia shares by 3.5%. The subsidiary Hyundai Mobis even lost 5%.

A reminder: The October deal

At the APEC summit in Gyeongju, Trump and President Lee agreed:

South Korea invests $350 billion in the US (primarily shipbuilding)

The US lowers tariffs from 25% to 15%

South Korean chips should not be treated worse than Taiwanese ones.

Since Seoul has not yet passed the legislation, Trump is now returning to the original punitive rate.

Next escalation: 100% on chips?

Commerce Secretary Lutnick threatened last week: "Anyone who wants to sell memory chips in the US pays 100% tariff or builds in America."

Samsung and SK Hynix control 60% of the global market, which gives Seoul bargaining power.

👉🏻 Because: SK Hynix's High-Bandwidth Memory is indispensable for AI—and is already sold out for 2026.

📊 All details & data: BBC, CNBC, The Straits Times

OUR PARTNER

Hiring in 8 countries shouldn't require 8 different processes

This guide from Deel breaks down how to build one global hiring system. You’ll learn about assessment frameworks that scale, how to do headcount planning across regions, and even intake processes that work everywhere. As HR pros know, hiring in one country is hard enough. So let this free global hiring guide give you the tools you need to avoid global hiring headaches.

NUMBER OF THE DAY

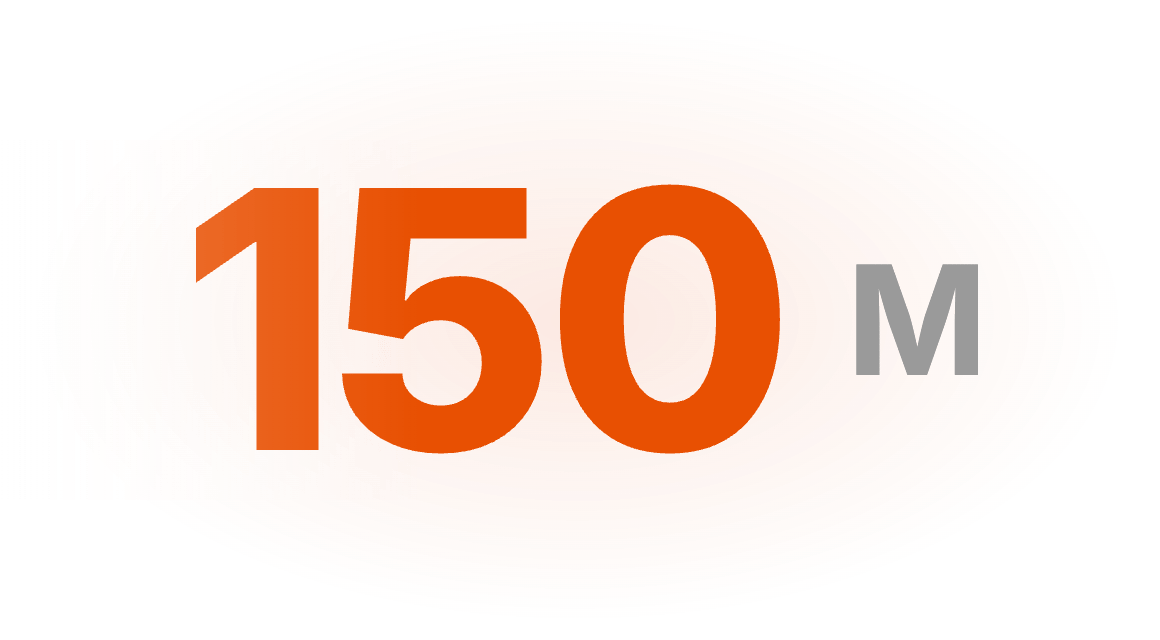

So many tons of ore China’s largest copper mine Julong can now process per year after completing its second expansion phase.

⛏️📈 Zijin Mining operates the world’s highest-altitude mega copper deposit in Tibet. Annual copper output rises from 150k to up to 350k tons. Amid the current safe-haven rush into commodities, the stock is up +5.2%.

MARKET BIT

China’s AI capital is concentrating: StepFun raises $720M

Shanghai-based AI startup StepFun, founded in 2023, has raised over 5 billion yuan (~$720M) in a Series B+ round.

The deal marks one of the largest private LLM financings in China to date. StepFun develops multimodal large language models and integrates them directly into end devices — smartphones, vehicles, and robots.

The Details

The twist: Founded by Jiang Daxin (ex-Microsoft VP), StepFun pursues a different path than cloud-centric competitors. Instead of delivering AI only via servers, its models run directly on devices.

Strategy: “AI + Terminals”:

42M smartphones already integrated with StepFun AI

Geely uses StepFun’s voice LLM for smart cockpits

Target 2026: 1M vehicles running StepFun models

👉 Faster response times, less data transfer, deeper integration.

Investor mix: Existing shareholders Tencent, Qiming Venture Partners, and 5Y Capital doubled down. New investors include state-linked funds such as Shanghai SSCI, China Life Private Equity, and Huaqin Technology(smartphone ODM for Oppo and Vivo).

New Chairman: Yin Qi (38), co-founder of facial recognition unicorn Megvii, takes over as chairman. He also leads Qianli/Afari, a Geely-backed smart-driving startup.

Flagship model: Step 3 Multimodal (text + vision), high decoding efficiency. Benchmarks draw comparisons to DeepSeek R1.

Background

Fewer deals, larger tickets: Chinese AI startups closed fewer rounds in 2025 than in the previous year, but average deal sizes increased significantly. The direction is clear – institutional investors are increasingly betting on the combination of hardware and software.

Best example in this case: Huaqin Technology, smartphone ODM for Oppo and Vivo, is investing in an LLM developer for the first time because StepFun is clearly targeting integration into end devices.

👉 Full story: DealStreetAsia, Kr-Asia, Yicai Global

HEAD OF THE DAY

🇮🇳 Nikhil Kamath

📉 The dropout who rewrote India’s stock market

Nikhil Kamath is the co-founder of Zerodha, India’s largest stock brokerage. But he didn’t get there the usual way. He dropped out of school at 14, became a professional trader in his teens, and learned the markets by losing (and making) real money.

A simple, disruptive idea: Cut trading fees to near zero and make investing accessible to everyday Indians.

The result? Zerodha serves millions of users, dominates India’s trading market, and operates profitably without venture capital or flashy hype.

Kamath keeps a low profile but isn’t afraid of big questions. Through his writing and podcasts, he openly challenges ideas around wealth, success, and capitalism.

ASIABITS CONNECT

How three people pull off what others need ten for.

If you’ve seen our podcast, you were probably just as surprised as we were by the insane production quality. That’s the work of our Philippine editor, Ralph.

👉 What we’ve learned: The best talent today can be found anywhere. Especially in Asia.

Asiabits connects you with hand-picked talent from across Asia — editors, designers, developers, VAs. Personally vetted. Ready to deploy.

→ Inquire now: [email protected]

HIGHLIGHTS

🇰🇷 90% of South Koreans see nuclear power as necessary: The government has now approved two new reactors with a combined capacity of 2.8 gigawatts by 2038, plus a Small Modular Reactor by 2035. The driver is exploding electricity demand from AI data centers. As an isolated power grid with no connections to neighboring countries, Korea cannot rely on 100% renewables. With this move, Seoul is definitively turning away from the nuclear phase-out course of the previous administration.

🇯🇵 SoftBank cancels mega Switch deal: Masayoshi Son wanted to acquire the US data center operator Switch for around $50 billion as the infrastructure backbone for the $500 billion Stargate project with OpenAI. The deal is off the table; talks are now focused on a minority stake. Switch is also preparing an IPO in parallel with a $60 billion valuation. SoftBank only recently acquired DigitalBridge, which already holds a majority stake in Switch.

🇭🇰 Morgan Stanley expands aggressively in Asia: The bank is hiring new financial advisors and expanding commodities as well as capital markets. Its Asia business reached $9.4 billion in revenue in 2024 (+23%), marking the second consecutive record year. Trading volumes in China are booming in particular. Investors are shifting out of low-yield bank deposits into dividend stocks, a trend previously seen in India and now being encouraged in Japan.

🇿🇦 Chery acquires Nissan plant in South Africa: The Chinese automaker is buying the factory in Rosslyn, opened in 1966, including the press shop, and is taking over most of the workforce on similar terms. For Nissan, this is part of a global restructuring: 20,000 jobs are being cut and the number of plants reduced from 17 to 10 by 2027. For Chery, it marks the next step in its overseas push – international sales rose by 17% in 2024 to 1.34 million vehicles.

FORTUNE COOKIE

Things you see in China’s parks. 😂

MORE ASIABITS

All the latest AI trends from Asia — every Wednesday, exclusively with us.

The Asiabits Podcast on YouTube.

The Asiabits Podcast on Spotify.

YOUR FEEDBACK

How do you like today's briefing? |