- asiabits

- Posts

- 🤖 Nvidia Boss: Today Trump, Tomorrow Xi

🤖 Nvidia Boss: Today Trump, Tomorrow Xi

Reading time: 4 min 50 sec

☕️ Good morning, friends,

Even this week, a lot of people have joined asiabits. We warmly welcome everyone, especially our new friends from Deutsche Bank.

Thomas, as a former Sparkasse banker, is particularly pleased that you’re here.

In other news: a Chinese government official fell into the classic “honey trap.” He succumbed to the “seductive beauty” of a female spy and was then blackmailed by her.

REFERRAL

Share asiabits and invite your friends to join a growing community of hundreds of diplomats, founders, and executives from Deutsche Bank, Google, and WeChat. 👇🏻

BENCHMARKS

| Index | Current | 24 h % | YTD % | 52W-H |

|---|---|---|---|---|

| 🇩🇪 DAX | 24,456.81 | –0,38 | +22,13 | 24,639.10 |

| 🇺🇸 NASDAQ | 20,630.66 | +0,09 | +7,00 | 20,655.39 |

| 🇰🇷 KOSPI | 3,183.23 | +1,58 | +32,69 | 3,137.17 |

| 🇯🇵 Nikkei | 39,646.36 | –0,44 | +0,86 | 42,426.77 |

| 🇭🇰 Hang Seng | 24,028.37 | +0,57 | +22,45 | 24,874.39 |

| 🇨🇳 Shanghai | 3,509.68 | +0,35 | +7,57 | 3,674.41 |

NUMBERS

37 million USD

This is how much Singapore’s largest food company, Food Empire, is investing in spray-dried coffee production in India.

39%

That’s how much Taiwanese chip manufacturer TSMC’s revenue rose in Q2, signaling strong demand for AI chips.

1,000

That’s how many unicorns and gazelles Shanghai aims to foster within three years to create new economic drivers.

TOP BIT

💾 Jensen Huang: Shuttle Diplomacy Between Trump and Xi

Nvidia CEO Jensen Huang meets President Donald Trump at the White House today and will then fly straight to Beijing to discuss a China-specific version of the new AI chip with senior officials. The model is designed to meet all U.S. export requirements so that Nvidia can play again in China—its 13 % revenue market. At the same time, the company just celebrated its historic $4 trillion valuation.

The Details

🚦 Export Talks: Huang is asking Trump for clarity so the new China chip can be sold without special licenses.

✈️ Diplomacy Trip: In Beijing, he’ll meet Premier Li Qiang and Vice Premier He Lifeng to build confidence in stable supply chains.

💸 Revenue Gap: Previous export bans carved out a roughly $8 billion hole; the slimmed-down model is meant to fill it.

🏭 Chip Adaptation: The China version drops the high-end extras but remains powerful enough for cloud AI—while easing U.S. security concerns.

⚔️ Competitive Pressure: Huawei and others are using the pause to grab market share in the $50 billion China segment.

Why It Matters

Market access – An approved China chip preserves Nvidia’s presence in the fastest-growing AI market.

Geopolitics – Huang acts as a bridge between Washington and Beijing amid chip sanctions.

Pressure on rivals – If Nvidia re-enters, Huawei & Co. will feel the squeeze.

Background

Repeatedly tightened U.S. controls forced Nvidia to withdraw its top chips from China. Chinese companies have since tested domestic alternatives but remain tied to Nvidia for software ecosystem and know-how. With this shuttle diplomacy, Huang aims to keep the world’s largest AI market open while complying with U.S. security mandates.

📊 All Data & Details: Financial Times, Reuters, Bloomberg

PARTNERSHIP

Become Our Partner

Swap bot clicks and influencer blah-blah for genuine relevance.

asiabits reaches a growing daily community of young, international professionals who need to know Asia—before everyone else catches up.

Our native placements give you:

High-quality attention in the right context

100 % format-audience fit

Full brand safety—no BS, no distractions

Position your brand in the most relevant Asia newsletter in German-speaking markets.

👉 [email protected]

HEAD OF THE DAY

🇭🇰 Solina Chau

🤝 From media pioneer to tech magnate: Solina Chau studied at the University of New South Wales and co-founded the Tom Group with Li Ka-shing. In 2002, she co-founded Horizons Ventures and invested over USD 470 million in more than 80 tech startups like Facebook, Zoom, and Celsius. World premiere: her fund was one of the first VC backers of Facebook outside the U.S.

👉 Lesson learned: Bold early-stage investments and a strong network are keys to success. Real disruption happens when you spot opportunities before everyone else.

MARKET BIT

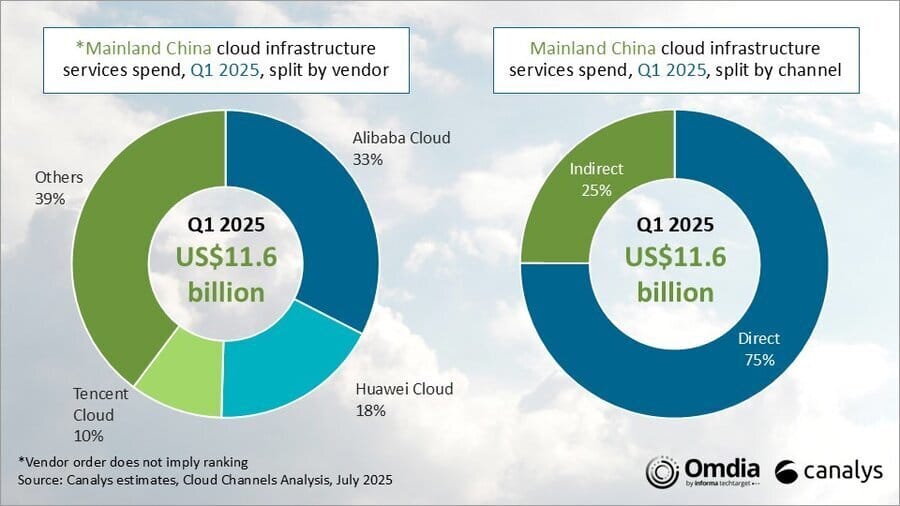

🤖 11.6 billion USD: ☁️ AI Drives China’s Cloud Boom

Details

💰 Record revenue: 16 % more than a year ago. Companies are renting ever more computing power to kick their AI projects into high gear.

🏆 Market leaders: Alibaba Cloud holds 33 %, Huawei 18 %, Tencent 10 % market share – all three are pouring money into new data centers and their own AI models.

🧩 Ecosystem boom: A quarter of revenue already comes via partners – from software vendors to startups deploying ready-made chatbots on the platform.

🚀 GPU goldmine: Instead of buying expensive servers, companies offload AI workloads to the cloud. Demand for GPUs for training and inference has therefore skyrocketed.

Why It Matters

Innovation engine: The more affordable compute is available, the faster developers can experiment with new ideas—from voice assistants to drug discovery.

Lower barriers to entry: Startups no longer need their own data centers; they simply pay for what they use, accelerating new business models.

Global signal effect: If China’s cloud continues this rapid growth, U.S. incumbents and European providers will face mounting pressure on pricing and technology.

TOP READS

🇸🇬 Singapore leverages trade conflicts for Europe investments: its sovereign investor sees attractive valuation levels in Europe amid global market volatility. Having invested over S$10 billion there last year, Temasek now plans further deals in industry, renewables, and financial services. Full story.

🚗 Suzuki launches mass-produced electric vehicle in Japan: The Japanese automaker will release its first mass-produced electric vehicle, the e Vitara, in fiscal 2025. After launching in the U.K., the SUV will reach Japan with price and dates to be announced. Full story.

☢️ China signs Southeast Asia nuclear ban treaty: Beijing has assured Malaysia the pact will soon take effect. Meanwhile, the US is weighing high tariffs on ASEAN countries. With trade disputes and growing Chinese and Russian influence unsettling the region, these nations are now seeking greater stability. Full Story.

OPTIONAL READS

Taiwan: Kirin launches trial sales of its new beer brand Harekaze for the first time outside Japan. More on that.

Indonesia: President Prabowo aims for a full transition to renewable energy within 10 years, faster than previously planned. More on that.

South Korea: Busan begins Level 3 autonomous driving bus tests. More on that.

BEHIND THE BITS

🎤 asiabits goes global: Yesterday, we unveiled our vision to an international audience in Shanghai.

This little newsletter is just the beginning. We want to build a knowledge platform that connects smart (and good-looking—like all of you) young professionals.

Our vision:

A world where knowledge flows without borders and accelerates innovation globally.

We’re thrilled to have you all with us from the very start.

Send us your fortune cookie and win the highly coveted asiabits T-shirt!

Spotted something funny, interesting, or noteworthy in or about Asia? Send it to [email protected] and we’ll feature it right here!

Imprint:

The asiabits editorial team: Michael Broza, Thomas Derksen, Raymond Kwok, Eva Trotno and Cindy Zhang

Asiabits Co., Ltd. Room 413, 4/F, Lucky Centre, 165-171 Wan Chai Road, Wan Chai, Hongkong