- asiabits

- Posts

- 🟠 Japan finds rare earths

🟠 Japan finds rare earths

+ $200 million for Chinese robotics startup

☕️ Good morning, friends,

We are flying to Shenzhen today—25 degrees, palm trees, and AI on every corner. For the latter to work, you need plenty of rare earths—and Japan has just discovered a massive reserve of them.

More on that in the Top Bit.

Also in this edition:

LimX raises $200M: Shenzhen’s robot startup aims to make humanoids mass-market ready—starting at $22,730.

VinFast rolls out internationally: After 406,000 e-scooters in Vietnam, expansion begins into five foreign markets.

Kyoto vs. overtourism: Unannounced night raids on Airbnb rentals starting in April.

Enjoy the read! 📰

👉🏻 P.S. Partner of the week: Cathy Tax. China business ⬆️ Paperwork ⬇️

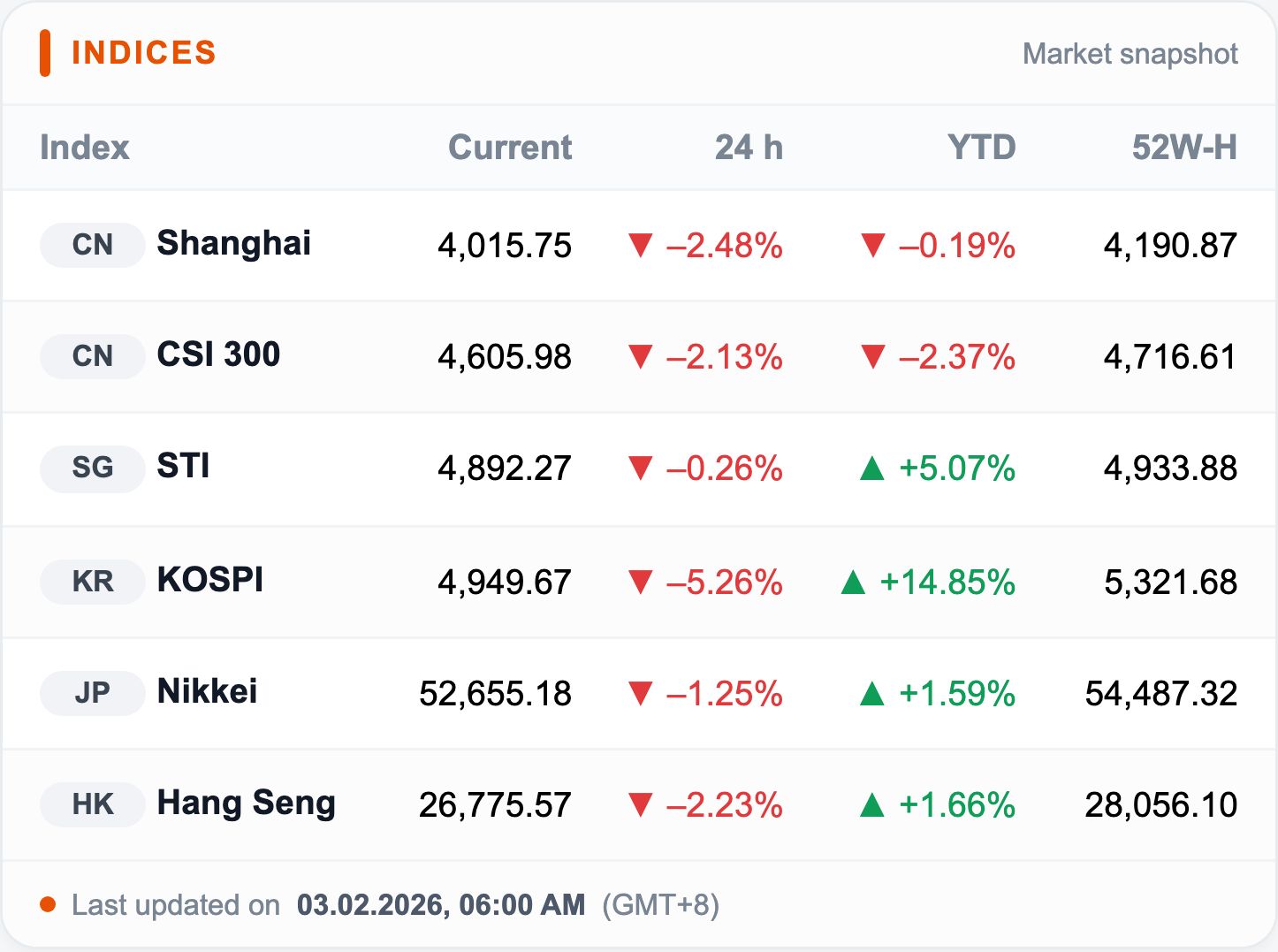

South Korea gets hit hard: The KOSPI slid more than five percent at the start of the month, falling below the 5,000 mark, with a sell-side circuit breaker briefly halting trading. The trigger was the global “Warsh shock,” which has dampened hopes for interest rate cuts.

Warsh shock: The market reaction to the prospect that Kevin Warsh could become the next chair of the US Federal Reserve. Warsh is widely seen as a clear monetary hawk.

TOP BIT

🌊 Japan drills for freedom: Rare earths from 6,000 meters deep

Japan has successfully recovered rare earth sediments from a depth of 6,000 meters in the Pacific for the first time—a world record.

The goal: To reduce dependence on China, which controls nearly 70% of global mining. The government calls it "the first step toward the industrialization of domestic rare earths."

Details

The Mission: Independence from the "Monopolist"

The research vessel "Chikyu" recovered muddy sediments from record depths near the Pacific island of Minamitorishima, 1,950 kilometers southeast of Tokyo.

The surrounding waters are estimated to contain over 16 million tons of rare earths.

These are the third-largest reserves in the world and enough to cover global demand for centuries.

The Technology: A mining machine on the seabed mixed the mud with seawater into a "slurry," which was pumped to the surface via a 6-km-long pipeline system.

The Treasures in the Mud

Why these metals are critical

These elements are indispensable for the mobility and energy transition:

Element | Application |

Dysprosium (Dy) & Neodymium (Nd) | High-performance magnets for EV motors |

Samarium (Sm) | Missile guidance and microwave technology |

Yttrium (Y) | LEDs and superconductors in medical technology |

Gadolinium (Gd) | Control rods in nuclear reactors |

Reality Check

Although the success of the test extraction is being celebrated, the path to industrial use is still long:

Costs: Operations at a depth of 6,000 m are extremely expensive. "Horizontal and vertical movements cause the highest costs," says the project leader.

Technology: The processing of seabed soil into refined rare earths has not yet been proven.

Timeline: Large-scale extraction (350 tons of mud per day) is not planned until February 2027.

📊 All details & data: Nikkei Asia, Japan Today, Aljazeera

IN PARTNERSHIP WITH CATHY TAX

Your China business is growing. So is the paperwork.

Company setup, taxes, bookkeeping, payroll, visas. In China, all of this is a little more complicated than elsewhere.

Cathy and her team know the rules, speak fluent English, and make sure you focus on your business, not on forms.

Book a free consult with Cathy now!

NUMBER OF THE DAY

This is how much the Trump administration is investing in "Project Vault" to break China's dominance in rare earths.

💎 Resource Reserve: The US is establishing its first commercial strategic reserve for critical minerals—funded by the largest-ever loan from the US Export-Import Bank ($10 billion) plus $1.67 billion from GM, Boeing, and Google.

The Context: China mines 70% of the world's rare earths but processes 90%. This week, Washington is hosting the first-ever raw materials ministerial meeting. Attendees include: India, South Korea, and Australia. Paradoxically, these are the very countries on which Trump is simultaneously imposing tariffs.

MARKET BIT

LimX raises $200m to push embodied AI into the real world

Source: LimX Dynamics Website

The Shenzhen-based embodied AI startup LimX Dynamics has raised around $200 million in a Series B round, marking one of the largest single financing rounds in the global humanoid robotics sector.

🤝 Global capital meets China’s robotics stack: The round was led by UAE-based Stone Venture, with participation from Chinese financial investors and strategic industry partners including JD.com, SAIC-affiliated funds, and NIO Capital.

The details

Platform over single robots: LimX combines hardware, software, and training into an integrated stack:

Tron 2: A modular, multi-form robot (bipedal, wheeled-biped, dual-arm)

Oli: A full-size humanoid designed as a standard deployment platform

COSA: An agentic operating system that links planning, prioritisation, and whole-body motion

Core innovation: Not a better model, but a system that continuously synchronises cognition and movement. COSA acts as an orchestrator between reasoning, skill libraries, and motion control — without scripts.

Scaling up: After raising RMB 500 million ($72 million) in Series A in early 2025, LimX is now entering its scaling phase. In 2026, the company plans to ramp up investment in product development and international expansion.

Coming to a lobby — and eventually homes: The LimX Oli humanoid starts at RMB 158,000 ($22,730) and is already available for pre-orders. Initial targets include service scenarios such as reception and household applications.

Sector Context

Robotics momentum: China’s embodied AI sector is moving beyond the lab. At the same time, Tesla has announced its first mass-produced humanoid robot.

State-backed funds, OEMs, and big tech players are no longer betting on individual robots, but on standardised platforms that can be industrialised at scale.

China’s focus is firmly on production reality: modular bodies, agentic OS layers, and vertically integrated stacks.

👉 Full story: Deal Street Asia, KrAsia, CnEVPost

HIGHLIGHTS

🇻🇳 VinFast expands e-scooters into five overseas markets: The Vietnamese manufacturer plans to roll out its electric scooters in five international markets in 2026 after delivering 406,453 units at home in 2025 and reaching market leadership. By 2027, hundreds of sales outlets and service workshops are planned, with the Philippines set to become the first strategic market. VinFast aims to push regional transport electrification with more than 10 models and battery-swap systems.

🇯🇵 Kyoto tightens controls to curb overtourism: From April, the city will introduce unannounced night-time and early-morning inspections of Airbnb-style short-term rentals after receiving 264 complaints over noise and waste. Operators of the 1,088 registered properties will be required to submit regular occupancy reports or face forced closures, while geographic restrictions are also under review.

🇨🇳 China’s “Nvidia clone” turns profitable: Cambricon expects its first annual profit in 2025 of RMB 1.85–2.15 billion, driven by strong domestic demand for AI chips as Nvidia and AMD are largely absent from the Chinese market. While export controls limit access to high-end technology, they are forcing a market-driven maturation that is finally pushing China’s major GPU players into profitability and freeing up capital for R&D.

🇰🇷 Korea’s memory lead holds despite China’s push: China’s state-backed DRAM drive led by ChangXin Memory Technologies is accelerating, but experts say South Korea’s lead remains secure. Samsung Electronics, SK hynix and Micron Technology control more than 90% of the global DRAM market and remain clearly ahead in AI-critical HBM, while CXMT is still several generations behind despite heavy subsidies and IPO plans.

FORTUNE COOKIE

Creativity survives any weather… ❄️🐰

MORE ASIABITS

All the latest AI trends from Asia — every Wednesday, exclusively with us.

The Asiabits Podcast on YouTube.

The Asiabits Podcast on Spotify.

YOUR FEEDBACK

How do you like today's briefing? |