- asiabits

- Posts

- 🟠 China warns against USD investments

🟠 China warns against USD investments

+ new record IPOs in the semiconductor industry

☕️ Good morning friends,

We have now grown to nearly 20,000 people and simply want to say thank you for reading along every day. 🫶🏻

In today’s edition:

Chip rally continues: Montage Technology jumps 60% at its HK IPO, raising $902 million.

South Koreans aren't reading: 4 out of 10 Koreans read virtually no books at all in 2023.

Harley rolls back in: Duty-free India deal for 800-1,600 cc bikes following their market exit in 2020.

Enjoy the read! 📰

👉🏻 We are organizing Robotics Tours in May and September. Interested? Send Michael or Thomas a DM for details.

Asian stocks jump sharply: Asian equities kicked off the week strongly, with Japan hitting a record high. A decisive election victory for Prime Minister Sanae Takaichi is fueling expectations of more growth-focused policies.

TOP BIT

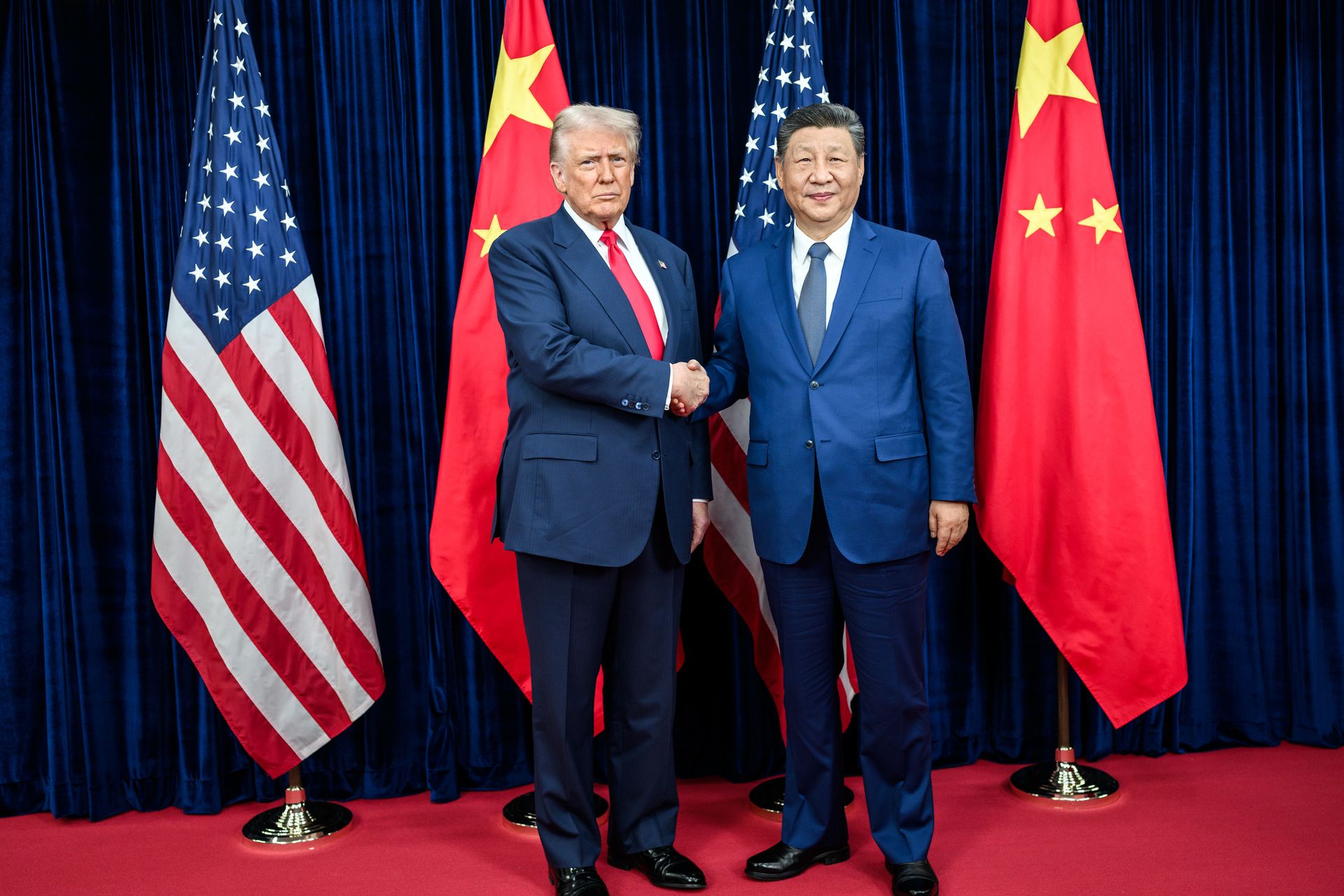

Beijing urges banks to reduce US Treasury holdings

Chinese regulators have instructed banks to reduce their holdings of US Treasury bonds.

Official reason: Concentration risks and market volatility. However, the timing shortly before the planned Trump-Xi summit is making global markets sit up and take notice.

The gradual farewell to the dollar

For years, China has been consistently reducing its official reserves of US debt—these recently fell to $683 billion, the lowest level since 2008.

The current instruction now targets commercial banks, which hold an estimated nearly $300 billion in US bonds.

Market reaction

Yields on US securities rose immediately after the news broke, while the dollar weakened slightly against the yen and euro.

Since 2025, the US dollar has been losing significant ground despite stable yields;

in other words, investors are avoiding the currency despite attractive interest rates.

The Big Picture

The debate over the attractiveness of US Treasuries as a safe haven is growing.

Concerns exist around Trump's stance on the dollar, the independence of the Fed, and the growing US debt burden.

Parallel to this, China has been buying gold for 14 months—reserves now stand at over $390 billion.

US Treasury Secretary Bessent countered: 2025 was the best year for the Treasury market since 2020, with record demand at auctions from foreign investors.

📊 All details & data: Business Insider, Yahoo Finance

OUR PARTNER

Transform Internal Comms Chaos Into Clarity

Simplify internal comms with Haystack. Publish updates, maintain approval workflows, and track engagement—all from a single platform designed to reduce chaos and keep employees aligned.

NUMBER OF THE DAY

That’s how many South Koreans barely read any books anymore.

📉 Reading in retreet: Teachers across the country report a broad decline in reading skills. Long texts are increasingly seen by students as “relics of earlier generations.”

🧠 The education paradox: Despite a high share of university graduates, the average reading literacy of Korean adults stands at 249 points, below the OECD average of 260.

Companies and universities are already responding with mandatory language and reading assessments.

Ironically, in the AI era, deep reading is becoming a core skill again. Anyone who wants to write good prompts, verify outputs, and grasp complex ideas needs strong language and text comprehension.

MARKET BIT

China’s chip rally in overdrive: Montage Technology jumps 60% after HK debut

Chinese semiconductor stocks remain a magnet for capital: Montage Technology, a specialist in interconnect chips, surged more than 60% in its Hong Kong IPO and raised US$902 million.

The details

Montage Technology priced its shares at the top end of the range at HK$106.89 and closed its first trading day at HK$175.

Demand was extreme:

Public tranche: over 700x oversubscribed

International book: around 38x covered

Critical to the semiconductor value chain: The company develops memory and interconnect chips for high-performance computing, data centers, and AI workloads.

Hong Kong as a global gateway: Montage is already listed on mainland China with a market capitalization of around US$27 billion. The Hong Kong listing clearly serves as a bridge to international capital.

Sector overview

The IPO adds to a growing wave of Chinese chip listings:

GigaDevice and OmniVision debuted in January

In the past year: Biren, Moore Threads, MetaX, Iluvatar CoreX

Beijing’s chip self-sufficiency push: Reduced reliance on U.S. suppliers such as Nvidia, whose most advanced chips can no longer be freely sold into China.

Rising domestic competition: Huawei and its chip unit HiSilicon dominate large parts of China’s local AI-chip market.

👉 Full story: Beijing Times, Investing, CNBC

HIGHLIGHTS

🇮🇳 Harley-Davidson rolls back into India duty-free: Under a planned US–India trade deal, Harley-Davidson motorcycles (800–1,600 cc) are set to enter India tariff-free. At the same time, India will gradually cut steep import duties on large US gasoline-powered luxury cars from as high as 110% to 30% over ten years. The deal is expected to be formalized by March, paving the way for a potential Harley comeback after its 2020 market exit.

🇻🇳 Billion-dollar bet on AI and data centers: Ho Chi Minh City has announced two flagship projects worth up to USD 1 billion each: a digital-asset fund for its new International Financial Centre, and a hyperscale AI and cloud infrastructure initiative led by G42 together with FPT Corporation. The plan includes multiple large data centers with full data sovereignty, backed by city support on land, power and permits.

🇨🇳 Meituan snaps up Dingdong Maicai: Meituan is acquiring Dingdong Maicai for around USD 717 million, securing one of China’s best-known quick-commerce players after JD.com had been widely seen as a potential buyer for months. The deal marks the largest local-services consolidation of 2026 so far and highlights how the quick-commerce battle is increasingly centered on scale, frontend warehouses and the “1+N” store model.

🇯🇵 Japan restarts its largest nuclear power plant: TEPCO has restarted Reactor No. 6 at the Kashiwazaki-Kariwa nuclear plant after a previous hiccup, targeting commercial operations from March 18. It is the first of seven reactors to come back online, with Reactor No. 7 also approved. The restart underscores Japan’s shift back toward nuclear power, but remains politically sensitive given Fukushima’s legacy and TEPCO’s role.

FORTUNE COOKIE

Where there’s a will, there’s a way. 💪🏻

MORE ASIABITS

All the latest AI trends from Asia — every Wednesday, exclusively with us.

The Asiabits Podcast on YouTube.

The Asiabits Podcast on Spotify.

YOUR FEEDBACK

How do you like today's briefing? |