- asiabits

- Posts

- 🟠 China snatches another key industry

🟠 China snatches another key industry

Reading time: 4 min 31 sec

Today’s edition is written by:

Anna, Michael & Thomas

☕️ Good morning friends,

A quick addition to yesterday's top story:

Sounds like a good idea, but when you think about it a bit longer, something isn't quite right… 🤔

P.S. Help us get better. 👇🏻

ON A PERSONAL NOTE

Give us 3 minutes of your time, and we’ll give you our 33-page China Insider Guide. Sounds fair?

Join our quick survey. 🤝

China widens ETF access: The largest expansion of the ETF Connect program since launch adds dozens of new products (including AI, aerospace and advanced manufacturing). The goal: attract more foreign capital, boost liquidity and raise institutional participation.

Korea’s Beauty-IPO wave: The KOSPI rally is pulling K-beauty firms to the market. Goodai (Beauty of Joseon, TirTir) is targeting a valuation above ₩10 trillion, with more cosmetics companies lining up to lock in peak valuations.

TOP BIT

🥇 China snatches Germany’s machine tool crown

‘Competition from China is causing us great concern’

Germany is losing its global dominance in yet another key industry:

For the first time, China’s machine tool manufacturers have replaced Germany as the world’s leading exporter in 2025.

Details

The changing of the guard: China claims 21.6% of the global export market, while Germany falls to 16.7%. While German exports slumped by 10%, Chinese exports grew by 18%.

“We all read the five-year plans.

Machine tools have been one of the most important focal points there for two decades.”

China conquers Europe: The share of Chinese imports in the EU has doubled to 10% in six years. In Germany, China is already the fourth most important supplier—behind Switzerland, Italy, and Japan.

Price pressure as a weapon: Chinese machines are significantly cheaper than German, Japanese, or Italian models. Bernhard is calling for anti-dumping proceedings: "We need a level playing field."

Good to know: Why machine tools are so important

Machine tools are the foundation of all industrial production. Without turning, milling, drilling, and grinding machines, there would be:

No cars, wind turbines, or bottling plants

No artificial hip joints

No lenses for smartphone cameras

Background

China has been preparing for this shift in power for 20 years through its five-year plans. Chinese manufacturers are now heavily integrating European components (controls, sensors) but offering the final products at a much lower price—often supported by state subsidies.

📊 All details & data: Press release (pdf), Börsenzeitung, WB (all German)

OUR PARTNER

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

NUMBER OF THE DAY

That’s how much waste China’s incinerators can process each day.

🔥 Too many furnaces, not enough trash: China operates more than 1,000 waste-to-energy incinerators. In parts of the country, many plants are running well below capacity. Recycling and weaker consumption are worsening the oversupply.

🌏 Trash hunt in Southeast Asia: Countries such as Vietnam, Indonesia and the Philippines are running out of landfill space. Chinese firms are exporting waste-to-energy technology, building plants locally and locking in new markets, often via joint ventures or EPC models.

Watch: Overcapacity is pushing WtE firms abroad, while Southeast Asia provides landfill stress and demand. New incinerators tie cities to specific technology, capital and operators for decades.

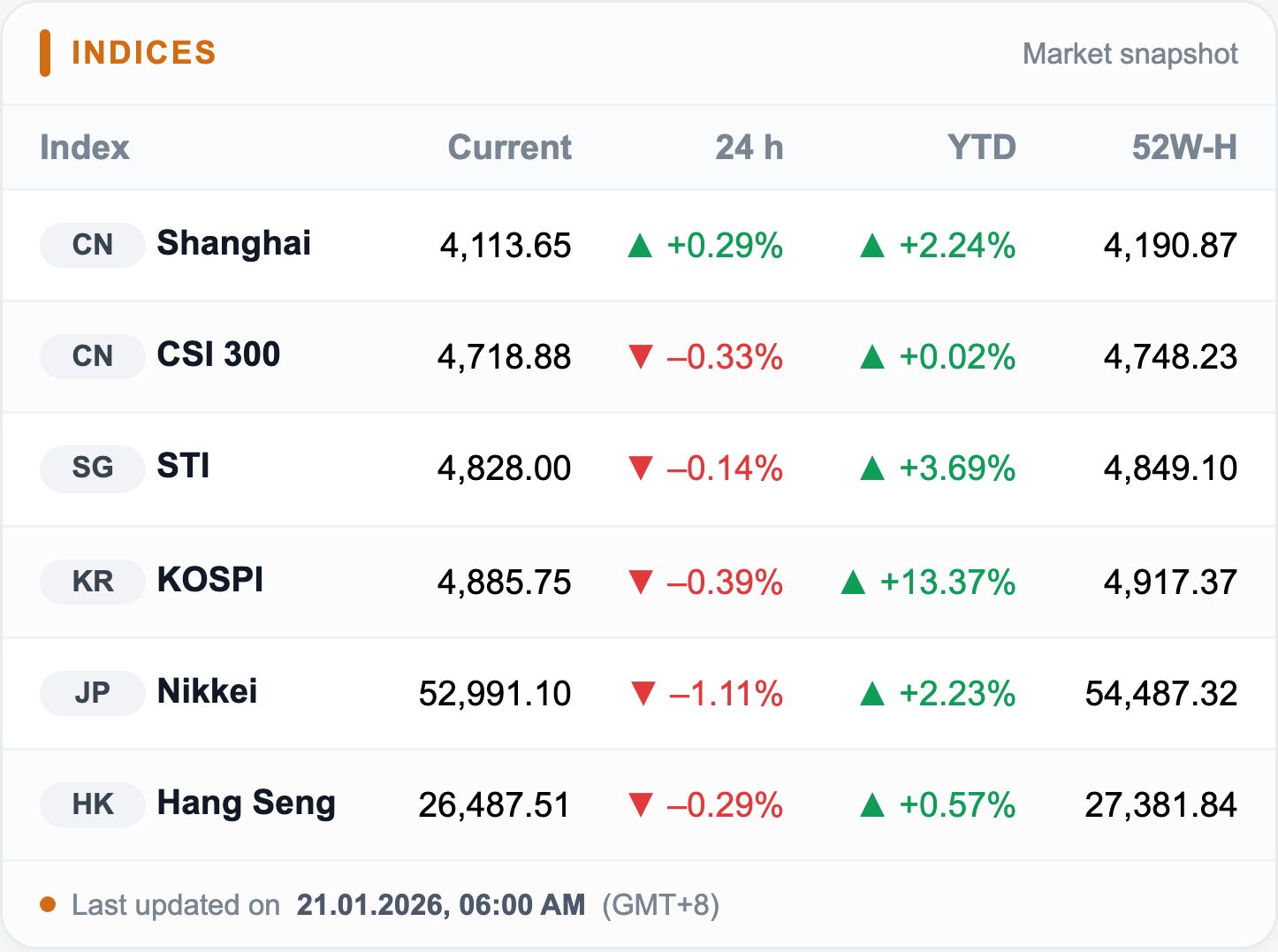

MARKET BIT

📺 Sony shifts TV business to China: Joint venture with TCL

Sony is restructuring its TV business and folding its entire TV hardware operations into a joint venture with Chinese manufacturer TCL.

🤝 TCL Electronics will take a 51% controlling stake, while Sony retains 49%. The new joint venture will manage development, design, manufacturing, sales and logistics globally, continuing to operate under the Sony and Bravia brands.

The details

Strategic pivot: Sony is stepping back from the operational side of the low-margin TV hardware business, betting instead on scale, cost leadership and TCL’s display expertise. In return, TCL gains access to Sony’s image processing, audio technology and premium brand equity.

Timing: The agreement is not yet binding. Definitive contracts are expected by the end of March, with operations scheduled to begin in April 2027.

Market reality: Sony’s display segment (TVs, projectors) fell 10% to ¥597 billion (≈ $4.0 billion) in FY2025, ending March. Weakness in the display business continued to weigh on revenue and profits in the electronics division during H1 2025.

Sony draws conclusions: The group is doubling down on its entertainment ecosystem (IP, games, film and streaming). TVs shift from a core business to a “brand + technology” building block within a broader content strategy.

📺 Sector context

The TV market is moving toward larger, higher-resolution screens, but price pressure is intensifying. TCL, Hisense and Xiaomi are expanding aggressively overseas, winning share through scale and cost advantages.

More Japanese manufacturers are exiting the TV business or giving up control. Sharp went to Foxconn, Toshiba to Hisense, Panasonic exited production. Sony now chooses a middle path: the brand and technology stay Japanese, while operational control moves to China.

👉🏻 Full Story: Nikkei, TechBuzz, JapanToday

HEAD OF THE DAY

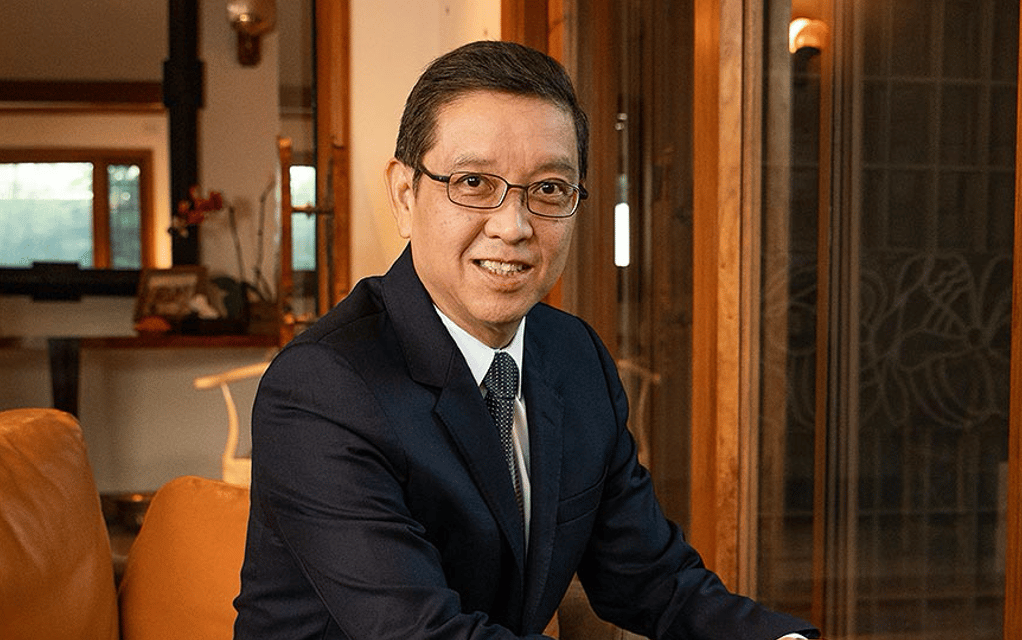

🇵🇭 Ernesto Tanmantiong

🍗 The man behind Jollibee’s global appetite

Ernesto Tanmantiong is the founder and chairman of Jollibee Group, one of Asia’s most ambitious restaurant empires. What started as a small ice-cream parlour in the Philippines has grown into a global F&B powerhouse with 10,000+ stores across 33 countries.

Why he matters:

Tanmantiong built Jollibee by doing what global fast-food giants rarely dared — embracing local taste and culture instead of copying Western formulas.

Sweet-style spaghetti and the cult-favourite Chickenjoy helped Jollibee beat McDonald’s on its home turf, before taking Filipino flavours to the world.

His playbook proved that going global doesn’t mean losing your identity.

Today, he oversees a diverse portfolio including Jollibee, Chowking, Mang Inasal, Smashburger, and Tim Ho Wan, and has an estimated net worth of over $2 billion.

HIGHLIGHTS

💨 India fuels up: India plans to double trade with the UAE to $200 billion by 2032, stepping up efforts to diversify partners as talks with the U.S. stall. Prime Minister Modi and UAE President Sheikh Mohamed bin Zayed signed a 10-year LNG deal worth $3 billion starting 2028, making India the UAE’s largest LNG customer. India has also pursued trade agreements with the UK, Oman, and plans one with New Zealand to offset U.S. tariffs.

💥 “Like selling nukes to North Korea?”: Anthropic CEO Dario Amodei blasted the U.S. plan to allow Nvidia to sell advanced AI chips to China, calling it “crazy”. He warned it could help Beijing catch up in AI, creating a “country of geniuses in a data center.” The Trump administration is moving forward with approvals for Nvidia’s H200 and similar chips, while adding a 25% tariff on shipments. Some Republicans are pushing to block the sales, even as MAGA influencers defend the policy.

🏛️ Mega-embassy in London approved: The UK government has cleared China to build its largest embassy in Europe on the former Royal Mint site, despite national security concerns. The complex will occupy a full city block near The Shard, raising fears over intelligence risks and surveillance. Security agencies said risks cannot be fully eliminated, while opposition parties, activists, and diaspora groups criticized the decision as a major security compromise and a blow to human rights advocacy.

COUNTRY READS

🇮🇳 India set to become a top Ikea market as the Swedish retailer plans to more than double its investment. More on this.

🇰🇷 Seoul introduces bilingual taxi receipts and English fare breakdowns to protect foreign passengers from overcharging. More on this.

🇯🇵 Toyota plans for new vehicles to average at least 30 % recycled materials by 2030, aiming to get ahead of upcoming EU rules. More on this.

✅ Invite your friends to a Vietnamese spring roll night.

✅ Learn about the lucky and unlucky numbers in China.

✅ Hike the Annapurna Circuit in Nepal, one of Asia's most spectacular.

✅ Fight the dry winter air with this Korean face mask.

✅ Stay up-to-date and follow us on Instagram.

FORTUNE COOKIE

New hairstyle inspiration for you all… 💇🏻

MORE ASIABITS

All the latest AI trends from Asia — every Wednesday, exclusively with us.

The Asiabits Podcast on YouTube.

The Asiabits Podcast on Spotify.

CAREER BITS

🌏 Sony Pictures: Business Analyst, Information Technology, Tokyo

🌏 Dyson: Assistant Communications Manager, Shanghai

🌏 Tencent: People Operation Manager - Employee Lifecycle, Shenzhen

🌏 OPPO: Senior Retail Marketing Manager, Dongguan

🌏 Samsung: Assistant Manager, Business Development, Bangkok

🌏 Grab: Associate, Account Management, Hanoi

🌏 SKF Group: Digital Product Information Manager, Bengaluru

🌏 Foxconn: Senior Data Scientist, Taipei

🌏 Hyundai: CRM Executive, Dublin

🌏 Huawei: Junior Project Manager, Prague

YOUR FEEDBACK

How did you like today's briefing? |