- asiabits

- Posts

- 🟠 China scoops up PUMA

🟠 China scoops up PUMA

+ Singapore gets a $24 billion chip plant

☕️ Good morning friends,

Our office is just two kilometers away from PUMA's Shanghai headquarters. We would love to be a fly on the wall there today. What do you think the mood is like?

Also in this edition:

Micron is turning Singapore into a memory chip hub with a $24 billion expansion.

Space tourism for $430,000 – China’s space startups are getting serious.

Head of the Day: Adrian Cheng – the man turning malls into art galleries.

Enjoy the read! 📰

👉🏻 Better business decisions through AI insights from Asia – sign up here.

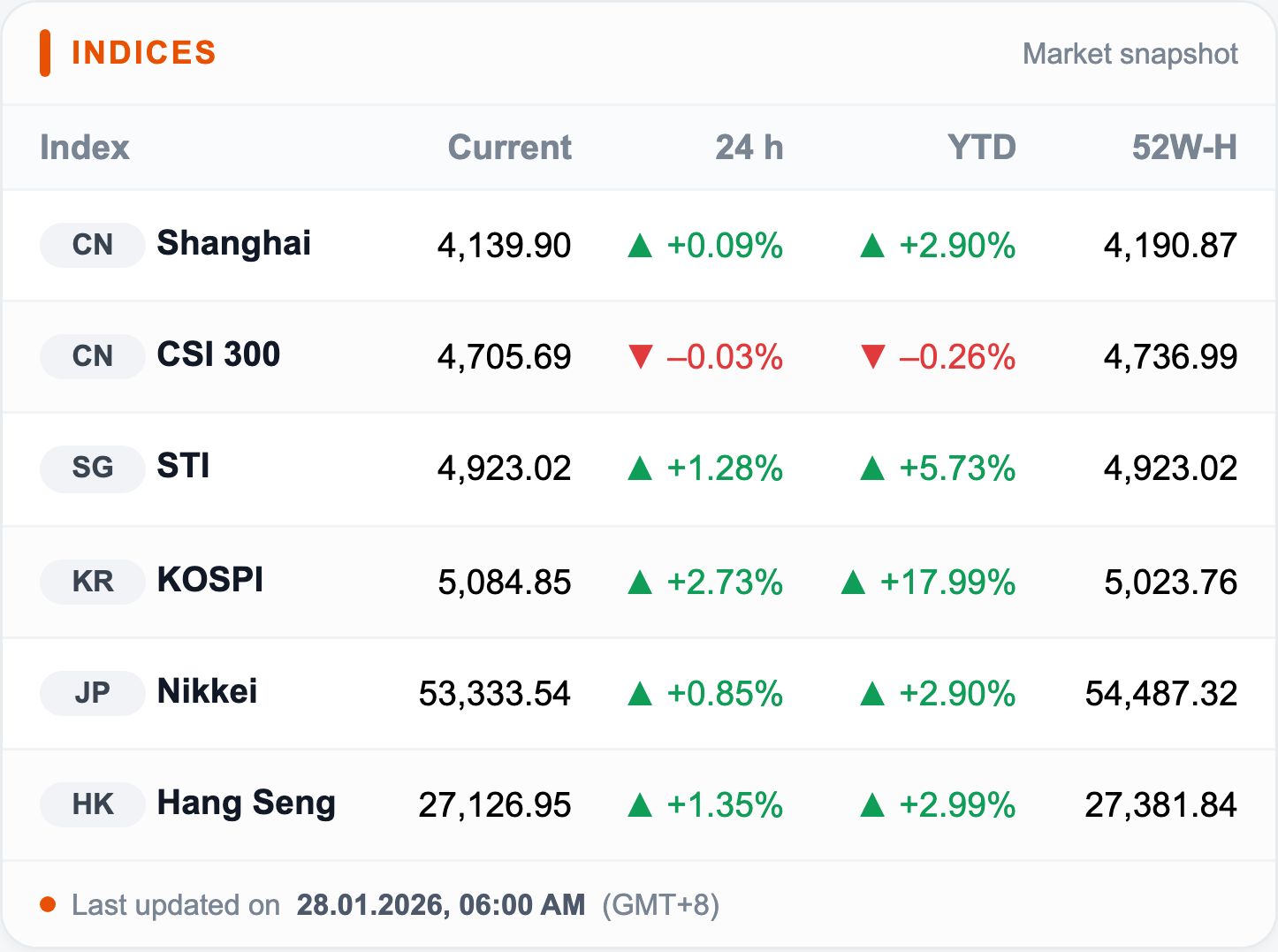

South Korea’s benchmark index closes above the psychological threshold for the first time at 5,084.85 points (+2.73%). Chip giants SK Hynix and Samsung are driving the rally, foreign investors are buying aggressively (₩850 billion), while retail investors are taking profits. Singapore’s STI simultaneously breaks above 4,900 points.

TOP BIT

Puma turns Chinese: Anta becomes largest shareholder

Chinese sports giant Anta Sports is acquiring a 29% stake in Puma for 1.5 billion euros, making it the largest shareholder of the struggling traditional German company.

For the "big cat" brand, this could be the lifesaving leap out of a years-long crisis.

The Details

Anta is purchasing 43 million shares from the French billionaire Pinault family (Artemis).

With a price of 35 euros per share, Anta is paying a premium of around 62% over the last closing price—a clear signal that the Chinese see massive potential in the brand.

Big cat under pressure

Puma has lost two-thirds of its market value over the last three years and now ranks globally behind New Balance and Skechers. Ironically, the decline began when former CEO Bjørn Gulden moved to arch-rival Adidas.

Puma also lags massively behind Adidas in China. Anta could help with distribution, branding, and supply chain—Citigroup analysts see "significant upside potential."

Good to know: Who is Anta?

Founded in 1991 in Fujian Province, today it is the third-largest sporting goods manufacturer in the world (behind Nike and Adidas).

In 2024, it overtook Nike as the market leader in China.

Official sponsor of the 2022 Winter Olympics in Beijing—Xi Jinping wore an Anta jacket.

🏔️ Anta’s brand collection: The portfolio already includes global brands such as Salomon, Wilson, Arc'teryx, and, as of last year, Jack Wolfskin. With Puma, the group now secures access to Formula 1 and strengthens its presence in Europe and North America.

📊 All details & data: CNA, CNBC, The Straits Times

OUR PARTNER

Keep pace with your calendar

Dictate investor updates, board notes, and daily rundowns and get final-draft writing you can paste immediately. Wispr Flow preserves nuance and uses voice snippets for repeatable founder comms. Try Wispr Flow for founders.

NUMBER OF THE DAY

This is how much a seat on China’s first commercial spaceflight costs.

🚀 Space tourism for the middle class: Startup InterstellOr has already signed up more than 20 high-profile Chinese customers, including film stars, tech executives, and poets. Its six-seat CYZ1 spacecraft is scheduled to cross the Kármán line — the boundary of space — in 2028.

Watch: China is heavily backing its commercial space sector. Rival Deep Blue Aerospace is even offering promotional tickets priced at around $140,000. That said, several critical technical tests are still pending.

For comparison: SpaceX tickets are rumored to cost around $50 million.

MARKET BIT

Micron plans $24 billion chip plant in Singapore

The US memory maker Micron is investing $24 billion in a new wafer fabrication plant in Singapore.

The facility will be built out over the next decade and is set to begin producing NAND memory chips in the second half of 2028, across 65,000 square meters of cleanroom space.

🏭 Doubling down on Singapore: About 98% of Micron’s flash memory is already produced there. In parallel, the company is building a $7 billion HBM packaging facility for AI chips, scheduled to come online in 2027.

The Details

Strategic shift: Micron is effectively concentrating its flash production in Singapore, turning the city-state into its core memory hub in Asia.

Parallel expansion: Micron is also in talks over a $1.8 billion DRAM fab in Taiwan.

Market reality: Forecasts point to a 55–60% price jump in enterprise SSDs. Micron ranks fourth in flash, with roughly 13% market share.

Supply tightness: Analysts expect persistent memory shortages through end-2027, as Samsung and SK Hynix also accelerate new production lines.

Background

🇸🇬 Singapore as a strategic node: Politically stable, IP-secure, and home to a deeply embedded supply chain for high-yield memory fabs.

The bottleneck is no longer compute, but memory integration. The AI boom is shifting constraints from processors to HBM, NAND, and advanced packaging—precisely where global capacity is scarce.

Enterprise SSDs and HBM are already being pre-booked via long-term contracts. Anyone without secured wafer capacity for 2026–2028 risks being shut out of AI supply chains entirely.

👉 Full story: DealStreetAsia, Nikkei

HEAD OF THE DAY

🇭🇰 Adrian Cheng 鄭志剛

🎨 The man who made malls cool

Adrian Cheng didn’t just build malls, he questioned why they existed at all. After stepping away from executive leadership at New World Development in 2024, Cheng made his priorities clear.

His belief: Modern luxury isn’t about ownership or scale, it’s about how a space makes you feel, what it teaches you, and who it brings together.

As the founder of K11, he reimagined the shopping mall as a cultural ecosystem: Part museum, part social club, part stage where art, fashion, food, and design collide.

ASIABITS CONNECT

How three people pull off what others need ten for.

If you’ve seen our podcast, you were probably just as surprised as we were by the insane production quality. That’s the work of our Philippine editor, Ralph.

👉 What we’ve learned: The best talent today can be found anywhere. Especially in Asia.

Asiabits connects you with hand-picked talent from across Asia — editors, designers, developers, VAs. Personally vetted. Ready to deploy.

→ Inquire now: [email protected]

HIGHLIGHTS

🧬 China could approve the first AI-developed drug in 2026: According to Merck executive Marc Horn, China may become the first country to approve a fully AI-developed medicine as early as 2026. Chinese pharma companies signed record licensing deals worth USD 135.7 billion in 2025, double the 2024 level. Around 30% of all new drug pipelines now originate in China. The government’s “AI Plus” program is expected to further accelerate development.

🚗 Porsche sales in China cut in half: The German luxury carmaker sold just 42,000 vehicles in China in 2025, less than half its 2022 peak of 96,000 units. The drop reflects a “perfect storm” of economic pressure and intensifying competition from Chinese automakers. Local brands are winning with digital features, while foreign players struggle with legacy systems.

💎 LVMH beats expectations on China rebound: The luxury group posted Q4 2025 revenue of €22.7 billion, topping analyst estimates of €22.2 billion. Asia excluding Japan showed clear improvement, with growth in the second half of the year. CEO Bernard Arnault warned of an “unpredictable” economic environment in 2026. China’s recovery is stabilizing, but remains uneven.

🇻🇳 VinFast takes over Vietnam’s e-scooter market: The Vietnamese manufacturer boosted e-scooter sales by 473% in 2025 to 406,453 units, becoming the second-largest player in the 3.4 million-unit market. Honda grew just 1.3%, while Yamaha fell 17.3%, dropped to third place. Stricter emissions rules in Hanoi and Ho Chi Minh City, limiting gasoline motorcycles from June 2026, are driving the shift.

FORTUNE COOKIE

When you are trying to fit in… 😂

MORE ASIABITS

All the latest AI trends from Asia — every Wednesday, exclusively with us.

The Asiabits Podcast on YouTube.

The Asiabits Podcast on Spotify.

YOUR FEEDBACK

How do you like today's briefing? |