- asiabits

- Posts

- 🟠 China’s retail war: Hunting for US shoppers

🟠 China’s retail war: Hunting for US shoppers

Reading time: 4 min 18 sec

Today’s edition is written by:

Anna, Michael & Thomas

☕️ Good morning friends,

In Japan, the term “Smart Home” is taking on a whole new meaning:

Toto's latest high-tech toilets now analyze your bowel movements via LED scan.

The "smallest room" measures shape, color, and volume, and sends personalized nutritional tips directly to your phone—for example, if you should eat more vegetables again. 🚽

P.S. Job of the week: Toto USA is looking for an Assistant Director of Creative. Best bathroom breaks of your life guaranteed.

More jobs in the job board at the very bottom. 🧻

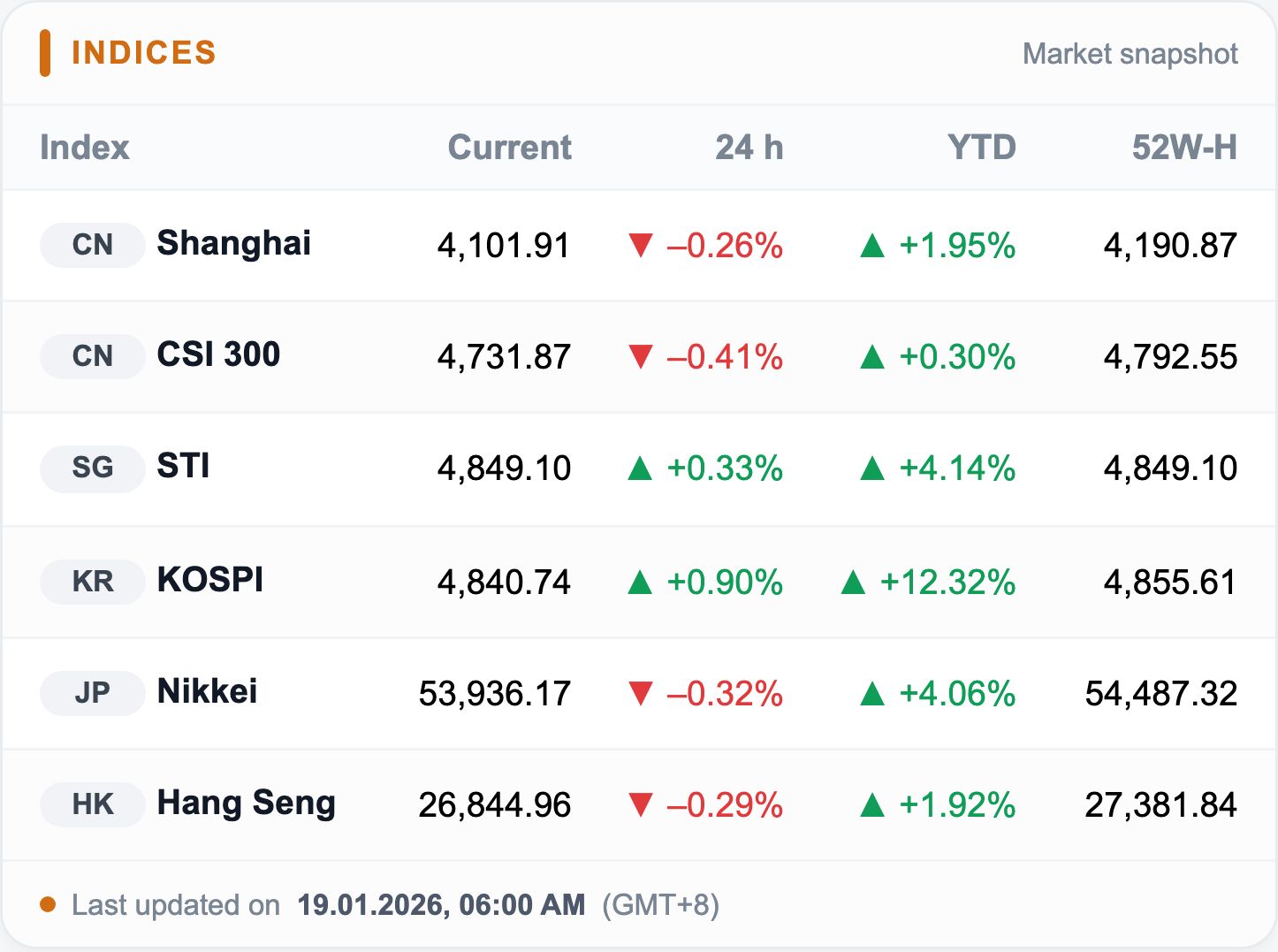

Foreigners hit the brakes: International investors sold about $1.2bn of Asian equities in December. Elevated tech valuations and year-end profit-taking made 2025 the biggest outflow year since 2022.

Asia opens cautiously, eyes on China data: Markets edged lower, weighed down by Trump’s Greenland tariff threats and jitters ahead of China’s GDP and key economic releases.

TOP BIT

🛍️ China’s consumer giants storm the USA

China’s latest export hit: Bubble tea.

Despite trade tariffs and political frost, a new generation of Chinese brands is conquering the US market.

As China’s domestic consumption stagnates, brands like Pop Mart (Labubu), Urban Revivo ("China’s Zara"), Luckin Coffee, and Mixue are expanding aggressively into the West.

The hope: 4 times higher profit margins than in China.

Details

📈 Explosive growth figures: Pop Mart recorded over 1,000% growth in North America in the first half of 2025. Miniso grew from 100 to 421 US stores in the last 24 months.

🎯 Gen Z target group: Younger US consumers who already shop on Shein and Temu are the main target audience.

"Chinese brands are positioning themselves as more affordable alternatives with increasing reliability."

— Morningstar analyst Ivan Su

🏀 Anta attacks Nike: China’s largest sports brand plans to open a store in Beverly Hills and is sponsoring NBA star Kyrie Irving. The goal: build brand awareness.

⚠️ Florasis shifts focus: The C-beauty label is shifting its focus from the USA to Japan, Southeast Asia, and Europe. The US market remains stable, but is no longer the top priority.

☕️ Coffee competition: Luckin Coffee and the ice cream chain Mixue are directly challenging Western giants like Starbucks by opening their first branches in New York.

🇪🇺 Plan B: Europe and Asia: China’s September exports rose surprisingly strongly, even though US shipments slumped by 27%. Stronger demand from the EU and Asia is compensating for the decline.

Why now?

China’s domestic consumption has been weakening since 2023. Brands that survived China’s brutal competition are seeking new markets.

For Chinese corporations, high-spending US consumers are more lucrative; with less pressure and competition, brands can charge them higher prices.

📊 All details & data: Jing Daily, The Economist

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

NUMBER OF THE DAY

That’s how many of the world’s new nuclear power plants since 2016 have come from China or Russia.

⚛️ Nuclear dominance: Seven of the nine large reactors launched worldwide last year were built in China, with Russia and South Korea accounting for the remaining two.

🇨🇳 China scales fast: 27 reactors are currently under construction. By 2030, capacity is expected to reach 110 GW, aiming to overtake the United States as the world’s largest nuclear power producer.

Watch: The U.S. has not started a new commercial nuclear plant since 2013. The AI-driven surge in electricity demand is now fueling political momentum for a comeback, initially centered on small modular reactors that promise faster and cheaper deployment.

MARKET BIT

💄 Shiseido loses ground as Asia’s beauty challengers accelerate

Thick skin required: Drunk Elephant becomes a heavy burden

🥱 Japan Sleeps In: Shiseido, Japan’s beauty giant, has lost significant market share since 2019. By 2024, its global share had fallen from around 7% to roughly half that level.

🐘 Drunk Elephant drag: The $845 million acquisition was meant to open the U.S. Gen Z market for Shiseido.

Instead, it led to a write-down of over 50%, falling sales, and supply-chain issues.

🇰🇷 K-beauty pulls ahead: South Korean groups like Amorepacific win with speed, social-media DNA, and rapid product cycles—especially in the U.S. market.

📉 Markets remain skeptical: Shiseido’s stock trades at roughly one-third of its 2019 peak. For 2025, the company is facing its first operating loss in decades.

✂️ Turnaround plan: ¥25 billion in cost cuts, fewer brands, stronger focus on premium and mid-priced segments, plus new areas like dermacosmetics. Drunk Elephant also relaunches in 2026 with an Instagram reset and a new campaign.

Target: 2–5% annual revenue growth and ≥10% operating margin by 2030.

Background

Competition is no longer just from L’Oréal & Co. Shiseido’s turnaround is playing out in a market being reshaped by other Asian players:

South Korean and Chinese brands are faster, cheaper, and social-native.

K-beauty leads: South Korea is set to export around $11 billion in cosmetics in 2025—globally dominant in skincare and product speed.

China on the rise: Exports at roughly $4 billion, imports declining. Local brands are gaining share at home and increasingly expanding globally.

👉🏻 Full Story: Bloomberg, Japan Times, Cosmetic Business

WORD OF THE WEEK

🇰🇷Arirang 아리랑

Whatever you think of them:

They’ve already been invited to the White House—and you haven’t.

Arirang (아리랑) is the title of the long-awaited comeback album by BTS

The term is composed of ari (beautiful) and rang (the beloved). It is the name of Korea's most significant folk song and is considered the "unofficial national anthem."

South Korea's ultimate soft power: The fact that BTS is naming their long-awaited comeback album after this 600-year-old cultural asset is "nation branding" at the highest level.

With this move, the group solidifies its status as the country's most important cultural ambassadors and transforms K-pop into a globally exportable cultural treasure.

HIGHLIGHTS

🇨🇦 Canada opens doors to Chinese EVs: Canada will lower its 100% tariff on Chinese electric vehicles to 6.1% under a capped import deal. In return, China will sharply reduce duties on Canadian farm exports, including canola. Prime Minister Mark Carney said the deal will diversify Canada’s trade, attract Chinese investment in the auto sector, and support net-zero goals. Critics warn it could strain ties with the U.S. and hurt domestic carmakers.

🎬 Sony goes Netflix-only: Sony will stream its films exclusively on Netflix worldwide, including upcoming titles like The Legend of Zelda, Spider-Man: Beyond the Spider-Verse, and The Nightingale. The rollout starts late this year, reaching full global availability by early 2029. The move marks a shift from Sony’s usual multi-platform approach, aiming to boost visibility amid tighter theatrical windows in Japan and Asia.

🚗 Meituan hits the road: China’s largest on-demand delivery platform is launching a new service with Passion Tech, letting users compare 4S dealerships, brands, and discounts in one place. The platform aims to feature 10,000 dealers and 30+ auto brands by year-end, leveraging Meituan’s digital expertise and Passion Tech’s AI-driven auto services. The move opens a new revenue stream as competition squeezes margins in Meituan’s core lifestyle services.

COUNTRY READS

🇯🇵 Japan is expected to see its first decline in foreign tourist arrivals in years in 2026, largely due to China’s travel advisory. More on this.

🇻🇳 Vietnam breaks ground on its first semiconductor chip plant, aiming to build domestic expertise and join the global supply chain. More on this.

🇪🇬 Egypt launches roadshows in Beijing, Shanghai, and Guangzhou to boost ties with China’s travel market and attract more tourists. More on this.

✅ Start your day the Wuhan way.

✅ Peek inside a tiny apartment in Hong Kong — don’t be shocked!

✅ Find out why standing on one leg is so good.

✅ Ride a sleeper train through Vietnam and try not to think about who slept there before you.

✅ Get ready for your next China trip with our asiabits China Guide.*

*Buy now and receive 30% with the code: Asiabits88. Thank you :)

FORTUNE COOKIE

We hope your lunch gets prepared as energetically as this stir-fried cauliflower! 🔥

MORE ASIABITS

All the latest AI trends from Asia — every Wednesday, exclusively with us.

The Asiabits Podcast on YouTube.

The Asiabits Podcast on Spotify.

CAREER BITS

🌏 Sony Pictures: Business Analyst, Information Technology, Tokyo

🌏 Dyson: Assistant Communications Manager, Shanghai

🌏 Tencent: People Operation Manager - Employee Lifecycle, Shenzhen

🌏 OPPO: Senior Retail Marketing Manager, Dongguan

🌏 Samsung: Assistant Manager, Business Development, Bangkok

🌏 Grab: Associate, Account Management, Hanoi

🌏 SKF Group: Digital Product Information Manager, Bengaluru

🌏 Foxconn: Senior Data Scientist, Taipei

🌏 Hyundai: CRM Executive, Dublin

🌏 Huawei: Junior Project Manager, Prague

YOUR FEEDBACK

How did you like today's briefing? |