- asiabits

- Posts

- 🟠 China's new weapon in the trade war?

🟠 China's new weapon in the trade war?

Reading time: 4 min 22 sec

Today’s edition is written by:

Anna, Michael & Thomas

☕️ Good morning friends,

Selfie of the year: South Korean President Lee takes a selfie with Xi Jinping using his Chinese (!) smartphone during his state visit—just adorable!

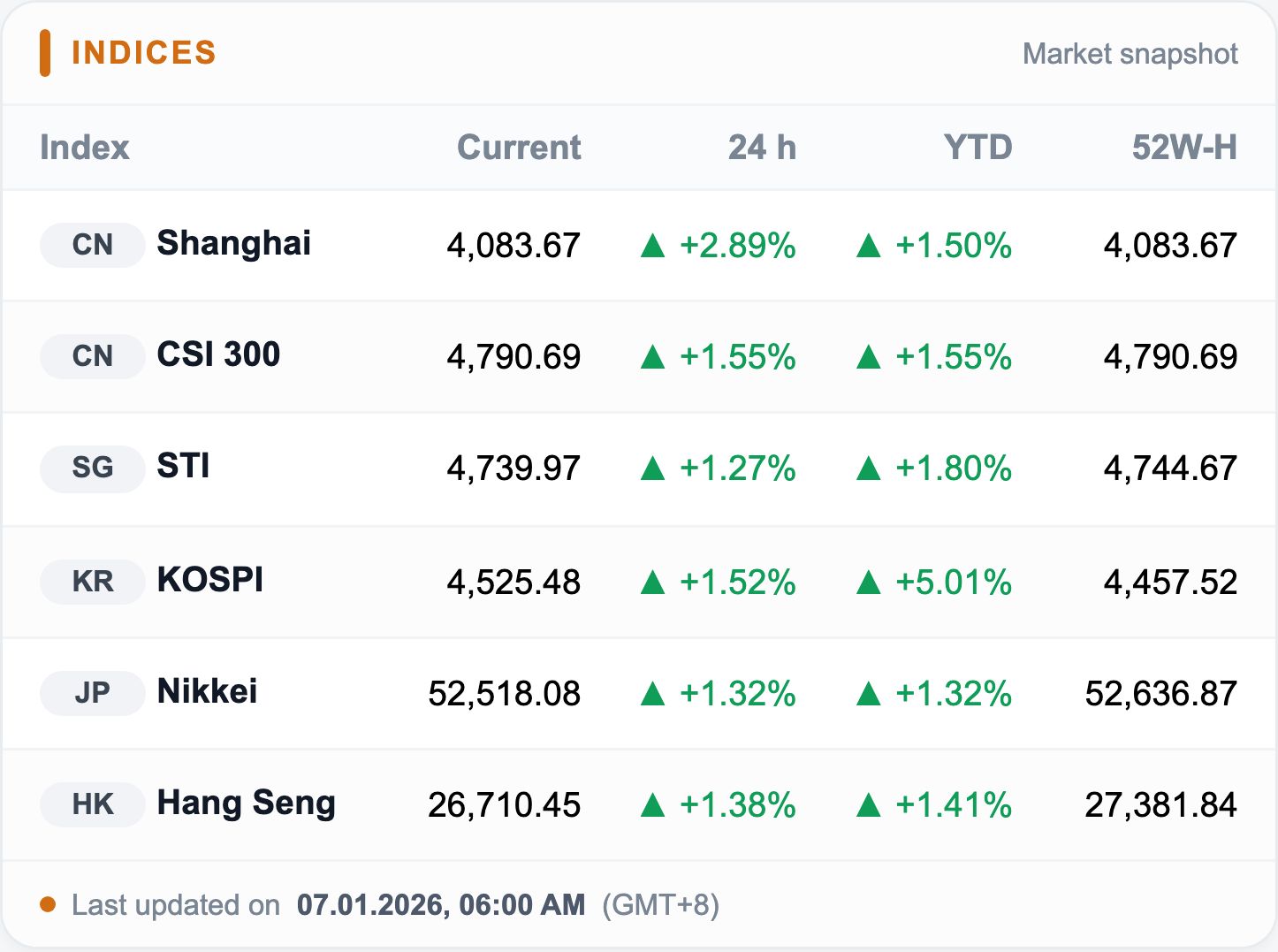

So far in 2026, Asia has known only one direction: up. China is hitting four-year highs, Japan is posting its strongest start to a year since 1990, Korea is chasing record after record, and Singapore has broken the 4,700 mark for the first time.

The MSCI Asia Pacific Index is off to its strongest start ever. After just four trading days, the region is up around 4%, marking the best opening to a year since records began.

TOP BIT

🥈 The new weapon in the trade war: silver

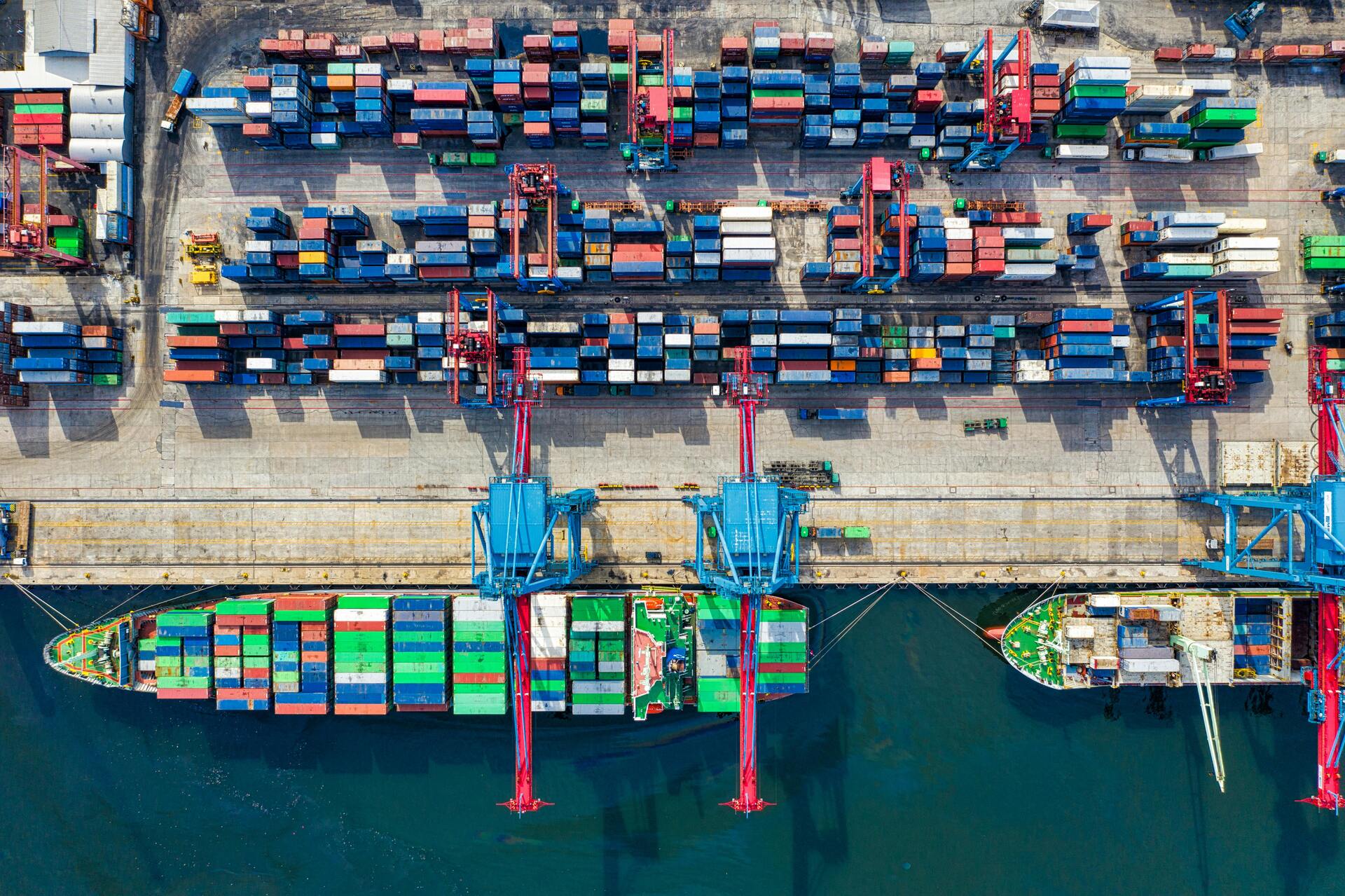

Since January 1, Chinese exporters need a government license for silver exports.

What sounds like bureaucracy is actually the birth of a new commodity weapon: China controls up to 70% of globally traded refined silver and is now elevating the metal to the same regulatory level as rare earths.

Musk is right: Without silver, the high-tech world grinds to a halt. A modern EV requires 25 to 50 grams, and a single solar panel needs around 20 grams of the metal.

Details

📈 Record chase: Silver had its best year since 1979 in 2025. The price more than doubled in 12 months (briefly exceeding $80 per ounce).

⚡ Indispensable for green tech: Silver is the most electrically conductive substance and is virtually irreplaceable in solar panels, EVs, and AI data centers.

🛡️ Defense: The precious metal is also critical for modern weapons systems. The US hastily added silver to its "critical minerals" list in November 2025.

🏭 China means business: Only 44 companies received export licenses for 2026-2027. Requirements: 80 tons of annual production capacity and a $30 million credit line.

⛏️ The supply trap: Silver is 70–80% a byproduct from copper or zinc mines.

This means: Even if the price explodes, you can't simply produce "more silver"—you'd have to mine more copper first. This makes supply extremely inelastic and Beijing's control all the more powerful.

Can silver be replaced?

Theoretically yes, but substitution takes years: Copper can replace silver in solar cells, but converting a single factory takes 18 months. With 300 factories worldwide, that's at least 4 years—too slow for acute shortages.

📊 All details & data: CNBC, Economic Times, SCMP

OUR PARTNER

Smarter CX insights for investors and founders

Join The Gladly Brief for insights on how AI, satisfaction, and loyalty intersect to shape modern business outcomes. Subscribe now to see how Gladly is redefining customer experience as an engine of growth—not a cost center.

NUMBER OF THE DAY

That’s how much ice and snow was used this year at Harbin’s Ice and Snow World Park.

❄️ Scaling at sub-zero: Harbin opened the world’s largest ice and snow festival for the 42nd time. The park is 20% bigger than last year, featuring castles, sculptures, slides and light shows on a distinctly Chinese XXL scale.

💸 Winter turns into business: More than 14,000 companies are now active in China’s ice and snow tourism sector. Experience-driven formats, indoor venues and year-round offerings are turning winter into a scalable industry.

Watch: China’s ice and snow economy is projected to reach around USD 165 billion by 2027. Snow becomes show, as sub-zero translates here into positive figures.

MARKET BIT

🧘♀️ Yoga leggings for USD 2bn: Bain Capital goes after Korea’s “Lululemon”

🥢 Big Stretch: Bain Capital acquires Korean activewear star Andar. Total valuation: about KRW 500bn (~USD 2bn). The goal is a full delisting.

🧾 Two-step takeover: Bain first buys 43.66% from the founder and his holding company for KRW 216.5bn (~USD 165m), followed by a tender offer for the remaining shares at a 49.5% premium to the last closing price.

🔐 Deal with handcuffs: To prevent a last-minute reversal, the founder’s shares were pledged as collateral. In case of a breach, Bain can forcibly acquire the shares—an unusually tough move in consumer M&A.

👚 Growth over luxury: Founded in 2015 as a yoga brand, Andar expanded into women’s, men’s, and everyday apparel. H1 2025 revenue reached KRW 135.8bn (~USD 1.0bn), a record high. The fashion arm is now by far the company’s most important asset.

🌏 Asia encore: Bain doubles down on consumer in Asia. After streetwear with Mash in Japan, activewear in Korea follows—an up-and-coming segment.

Background

The deal is part of a new wave of Asian consumer takeovers: Starbucks China, Golden Goose, Burger King China, Pizza Hut, and KFC. After years of high valuations, many brands are now seen as “underinvested but brand-strong.”

The unusually tough deal structure stands out. The backdrop is the Namyang Dairy case: in 2021, the founder blocked a signed sale to Hahn & Co., triggering a years-long legal battle that the buyer only won in 2024. Bain wants no second Namyang—and has locked in the Andar deal with share pledges and clear enforcement rights.

👉🏻 Full Story: The Chosun Daily, PEdaily.cn, 36kr

ONLY FOR YOU

We’ve compiled our best insider tips for your China trip across 33 pages. 🧡

So you can get the most out of a visit to the Middle Kingdom.

And just for you, enjoy 30% off with code “Asiabits88”.

HEAD OF THE DAY

🇨🇳 Red Xiao 肖弘

🧠 Meta's new $2 billion wunderkind

At just 33 years old, Xiao Hong (nickname "Red Xiao") has landed the deal of the year: Mark Zuckerberg is buying his startup Manus for $2 billion.

From tinkerer to titan: Xiao started as a student with simple WeChat tools. He laid the foundation for his wealth through discipline: He repeatedly turned down multi-million dollar offers from ByteDance (TikTok) to realize his own vision of an "autonomous agent."

Strategic fox: To escape US sanctions against China, he simply relocated his company to Singapore in 2025. Only this move made the mega-exit to Meta possible.

New focus: After the deal, Xiao will be integrated directly into Meta's management to make the Llama AI actionable.

💡 Lesson learned: Xiao Hong is the prototype of the modern AI founder: technically brilliant, geopolitically sharp, and with the patience to wait for the right offer.

OUR PARTNER

HIGHLIGHTS

🍔 Jollibee plans US listing: Shares of Jollibee Foods jumped to a five-year high after the Philippine fast-food group unveiled plans to spin off its international business and list it in the US by late 2027. The move separates its steady home market from faster-growing overseas operations. With more stores abroad than at home and nearly half of revenue coming from overseas, the listing underscores Jollibee’s ambition to take on global giants like McDonald’s and Yum! Brands.

🔩 Nickel jumps on Chinese demand: Nickel prices jumped over 9 % in London, marking the biggest gain in more than three years. Prices for the metal, crucial for batteries, electric vehicles, and stainless steel, have risen more than 20 % since mid‑December. Aggressive buying in China’s domestic metals market, combined with growing worries over production risks in top supplier Indonesia, have fuelled the rally, despite a global oversupply.

✈️ Cathay downplays Air China stake sale: Cathay Pacific CEO Ronald Lam called Air China’s sale of a 1.6% stake a “tactical” move, stressing the Chinese carrier remains a long-term strategic shareholder. The sale helps Air China stay below Hong Kong’s 30% takeover threshold as Cathay prepares a major share buyback from Qatar Airways. Despite the reshuffle, control stays firmly with Swire Pacific, while Cathay signals confidence with strong business and an 80th-anniversary revival.

COUNTRY READS

🇨🇳 China proposes rules for AI “boyfriends” and “girlfriends” to protect minors and prevent harmful interactions. More on this.

🇰🇷 Samsung sees Q4 profit soar 160% on a global chip shortage and surging memory prices driven by AI demand. More on this.

🇸🇬 Airwallex to invest €200M in the Netherlands over five years, expanding its European operations. More on this.

BITS TO DO

✅ Turn any dish from meh to wow with homemade Chinese chilli oil.

✅ See how to prepare instant-noodles in 100 different ways.

✅ De-puff your face with a lymphatic drainage face massage.

✅ Enjoy a cocktail at Asia’s best bar.

✅ Get ready for your next China trip with our asiabits China Guide.*

*Buy now and receive 30% with the code: Asiabits88. Thank you :)

FORTUNE COOKIE

If you think it’s cold outside, you haven’t been to Harbin’s Ice Festival yet. ❄️

MORE ASIABITS

All the latest AI trends from Asia — every Wednesday, exclusively with us.

Champagne & Chopsticks — your Sunday guide to Asia’s best insider spots.

YOUR FEEDBACK

How did you like today's briefing? |