- asiabits

- Posts

- 🟠 China Good, USA Bad

🟠 China Good, USA Bad

German Companies Investments up 50% in 2025

☕️ Good morning, friends,

There’s a reason why there are more authentic German restaurants in Shanghai than Vietnamese ones…

Because the Germans, it seems, are still quite keen on doing business in China. More on that in our Top Story. 👇🏻

Also in this edition:

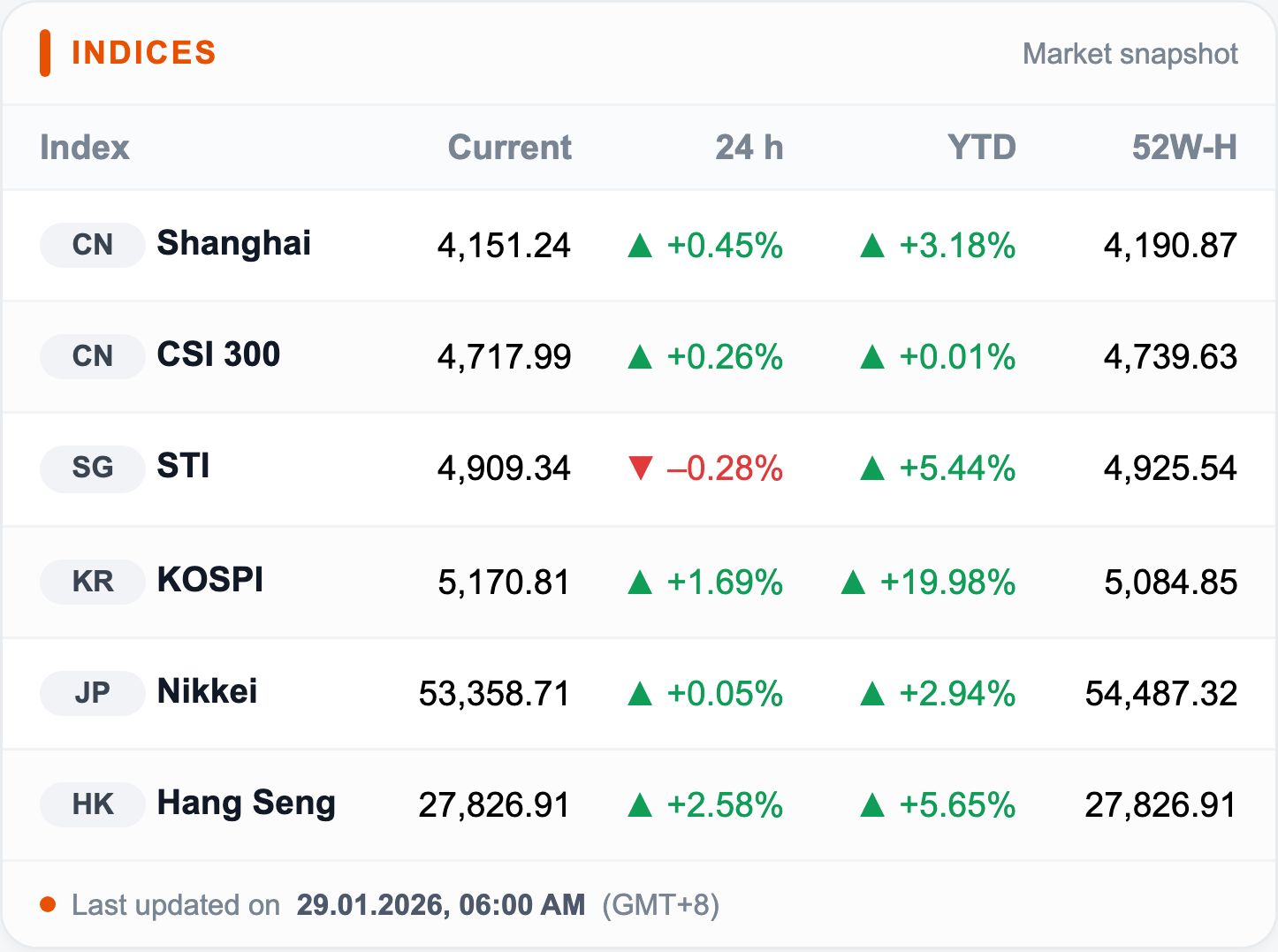

Indonesia on the watchlist: MSCI freezes all new Indonesian listings; the Jakarta Composite plunges by 8.8%.

Memory records from Korea: SK Hynix overtakes Samsung for the first time as the most profitable corporation, thanks to the AI chip boom.

VinFast without Lidar: Vietnam's EV manufacturer develops autonomous driving using only cameras—cheaper and ready for the mass market.

Enjoy the read! 📰

How to build AI products in Shenzhen (using a beef brisket grill as an example): Sean's story—watch it here. 😋

Jakarta Composite plunges: Indonesia’s benchmark index tumbled 8.8%, triggering a trading halt after MSCI put the market on its watchlist over transparency concerns and suspected coordinated trading.

All new inclusions of Indonesian stocks were frozen. Foreign investors have been heavy sellers since the start of the year, with $834 million in outflows in 2025.

TOP BIT

🇨🇳 German companies: China's a hit, USA's a miss

Nice photo ops and talks—yes.

But investments? Better not.

While politicians philosophize about "de-risking," German companies are creating facts on the ground: investments in China jumped to a record high of over €7 billion in 2025 (+50%). At the same time, direct investments in the USA plummeted by 45%.

Details

Engagement in the Far East has reached its highest level since 2021. What's particularly striking: the money comes predominantly from profits made by Chinese subsidiaries (€12 billion reinvested) that never even flow back to Germany.

In contrast, the fear of unpredictable tariffs is paralyzing German business in the US. In Trump's first year back in office, German direct investments in the US tanked by 45% (down to just €10.2 billion).

"In China, for China" Strategy

Major corporations are yielding to pressure from Beijing: value creation, product development, and even cutting-edge research are being relocated to China.

The goal: build local supply chains to protect against global tariffs and export restrictions.

For example, electric motor manufacturer EBM-Papst invested €30 million in Xi'an: "We develop and produce where our customers are."

⚠️ The Risk: While the strategy secures local market share, it increasingly decouples these corporations from their home base in Germany.

OUR PARTNER

Keep pace with your calendar

Dictate investor updates, board notes, and daily rundowns and get final-draft writing you can paste immediately. Wispr Flow preserves nuance and uses voice snippets for repeatable founder comms. Try Wispr Flow for founders.

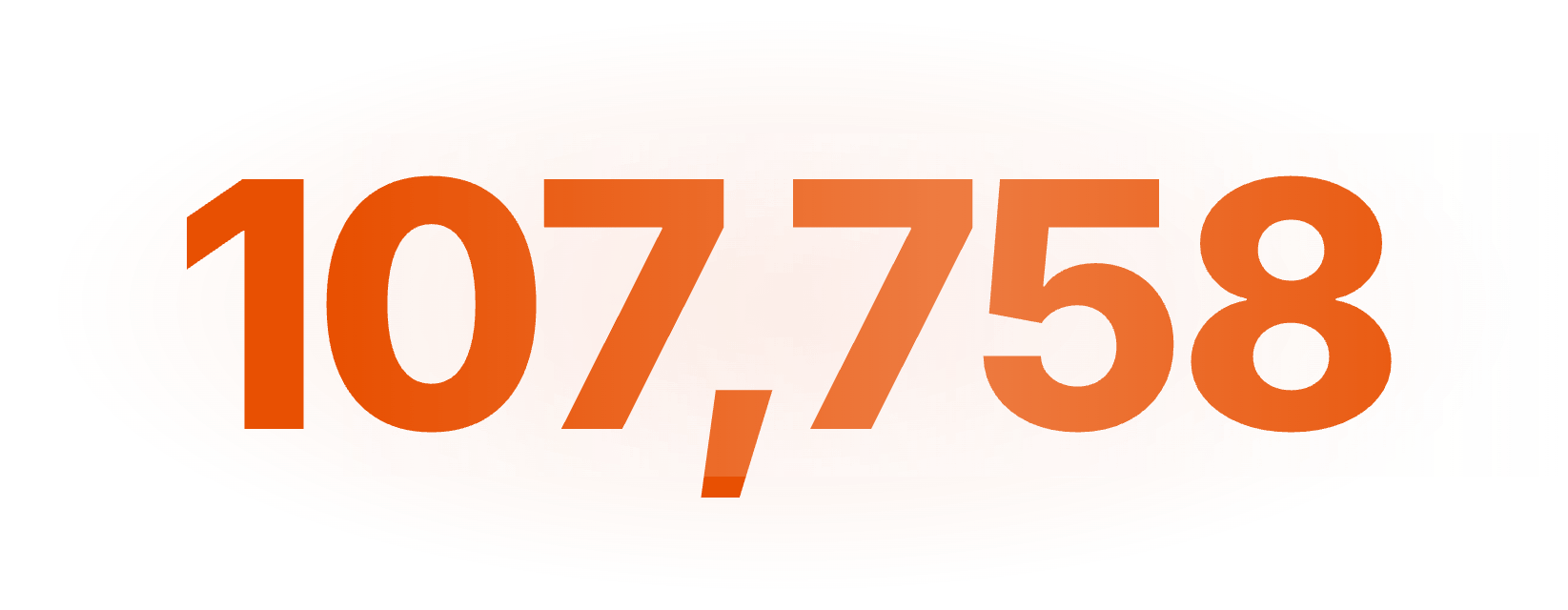

NUMBER OF THE DAY

That’s how many articles we’ve researched and processed over the past six months.

To do this, we built a system that curates and enriches these datasets — a true goldmine of insights, including:

600+ VC investors focused on robotics & automation

2,500+ robotics manufacturers, segmented by use case

400+ startup funding rounds across Asia

1,500+ AI & SaaS startups

5,000+ hardware and component manufacturers

…with new data added every single day.

This insider knowledge has already enabled 50+ concrete introductions between Western companies and Chinese players.

We help you source the right partner.

Which areas are you most interested in? |

MARKET BIT

Korea’s memory kings: Samsung and SK Hynix shatter all records

The AI boom is pushing South Korea’s chip giants to historic profits. SK Hynix has overtaken Samsung for the first time as the country’s most profitable company.

Samsung and SK Hynix both reported record results for the fourth quarter. Samsung tripled its profit to roughly $15.5 billion, while SK Hynix doubled earnings to about $14.7 billion.

🚀 SK Hynix takes the profit lead: In 2025, SK posts around $36bn in profit, overtaking Samsung at roughly $30bn. Samsung remains the revenue giant with about $255bn (+11%), while SK Hynix grows much faster, reaching around $97bn in revenue (+47%).

The details

SK pivot: SK Hynix is fully focused on premium AI chips and is the technology leader, already shipping HBM3E at scale and being furthest ahead on HBM4.

Samsung benefits too: The Device Solutions division delivered 16.4 trillion won (~$12.6 billion) in operating profit, driven by HBM and DRAM. Supply tightness is pushing up prices for PC and mobile memory.

Scarcity drives prices: Citigroup expects DRAM prices to jump by up to 120%, and NAND by around 90%.

Markets cheer: SK Hynix announced share buybacks of roughly $11 billion (14.3 trillion won) and plans an additional $10 billion of U.S. investment for its AI business.

Sector context

Instead of classic boom-bust cycles, AI’s hunger for HBM is delivering sustained utilization and margins. Hyperscalers are paying premium prices, while conventional memory segments face growing supply constraints.

Both Korean giants are now racing for Nvidia certification for HBM4. Whoever secures it at scale first will shape the next generation of AI infrastructure.

👉 Full story: Korea Herald, Yonhap, CNBC, Business Times

HEAD OF THE DAY

🇨🇳 Grace Wang 王来春

🔌 From factory floor to Apple’s inner circle

Wang Laichun didn’t start in a boardroom. She started on the assembly line.

In the 1980s, she was a factory worker at Foxconn, learning electronics manufacturing from the ground up.

In 2004, she co-founded Luxshare Precision, focusing on the unglamorous essentials: connectors and cables.

Today, Luxshare is one of Apple’s most critical suppliers, assembling AirPods and producing core components for iPhones and wearables.

Wang builds the infrastructure Apple can’t run without — and has grown Luxshare into a manufacturing giant worth tens of billions.

ASIABITS CONNECT

How three people pull off what others need ten for.

If you’ve seen our podcast, you were probably just as surprised as we were by the insane production quality. That’s the work of our Philippine editor, Ralph.

👉 What we’ve learned: The best talent today can be found anywhere. Especially in Asia.

Asiabits connects you with hand-picked talent from across Asia — editors, designers, developers, VAs. Personally vetted. Ready to deploy.

→ Inquire now: [email protected]

HIGHLIGHTS

🇨🇳 Jack Ma calls for an AI-driven education revolution: The Alibaba founder is urging fundamental reforms in China’s rural education system, warning that rote memorization is obsolete in the AI era. Since 2015, Ma’s foundation has supported 100 rural teachers annually with funding and training. Educators are encouraged to teach children how to use AI effectively, rather than competing with machines in calculation and memory.

🇻🇳 VinFast develops low-cost autonomous driving without lidar: The Vietnamese EV maker is partnering with Israeli AI firm Autobrains to build a camera-based driver-assistance system that eliminates expensive lidar sensors and HD maps. Using seven standard cameras and a high-performance chip, the approach aims to make autonomous driving far cheaper and suitable for mass adoption.

🇺🇸 Nvidia helped DeepSeek develop AI later used by China’s military: A US lawmaker has accused Nvidia of providing technical assistance to Chinese AI startup DeepSeek, enabling highly efficient models that were later allegedly used by the Chinese military. The support focused on training optimization using H800 chips that were legally sold to China before export controls in 2023. Nvidia has denied the allegations.

🇸🇬 Singapore bets on AI infrastructure: Rather than competing on proprietary AI models, Singapore is positioning itself in the global AI race through physical infrastructure such as data centers, power supply, and network capacity. Key beneficiaries include data-center REITs and energy providers like Sembcorp, which supplies around 44% of data-center electricity demand. AI adoption is rising across industry, transport, and banking to sustain productivity amid an aging society.

FORTUNE COOKIE

Is this what they mean by ‘don’t play with your food’? 😅

MORE ASIABITS

All the latest AI trends from Asia — every Wednesday, exclusively with us.

The Asiabits Podcast on YouTube.

The Asiabits Podcast on Spotify.

YOUR FEEDBACK

How do you like today's briefing? |