- asiabits

- Posts

- 🟠 Apple Loses: Huawei Reclaims No. 1 in China

🟠 Apple Loses: Huawei Reclaims No. 1 in China

Reading time: 4 min 44 sec

☕️ Good morning, friends,

It’s been proven once again: only inner values matter.

We can’t otherwise explain how the abbot of the famous Shaolin monastery managed to woo dozens of lovers and father little monks with them. See for yourselves…

He’s now behind bars for indulging earthly desires far too much—and neglecting the eternal ones.

Speaking of desires: in China, child benefits are now up to USD 1,500 per child.

P.S. You can help us grow our community. Please take a moment to share your personal link with all your friends, colleagues, and classmates. Thanks!

🤝 P.P.S. Early-bird tickets for our China AI webinar are almost sold out. Secure your spot now.

BENCHMARKS

| Index | Current | 24 h % | YTD % | 52W-H |

|---|---|---|---|---|

| 🇩🇪 DAX | 23,970.36 | –1.02 | +19.70 | 24,639.10 |

| 🇺🇸 NASDAQ | 21,178.58 | +0.33 | +9.84 | 21,202.18 |

| 🇰🇷 KOSPI | 3,209.52 | +0.42 | +33.79 | 3,237.97 |

| 🇯🇵 Nikkei | 40,998.27 | –1.10 | +4.30 | 42,065.83 |

| 🇭🇰 Hang Seng | 25,562.13 | +0.68 | +30.26 | 25,735.89 |

| 🇨🇳 Shanghai | 3,597.94 | +0.12 | +10.28 | 3,674.41 |

NUMBERS

278 million USD

That’s how much capital Shanghai’s Pudong economic zone is investing in a new AI fund for seed-stage startups.

1 million USD

That’s how high the average apartment price in Seoul has climbed, surpassing the million-dollar mark for the first time.

10,000

That’s how many delivery-only (ghost restaurants) JD.Com will open in the next three years in China. The company invests around USD 140 million fighting Meituan and Alibaba.

TOP BIT

📱 Huawei Overtakes Apple: Back as Market Leader in China

Unlike Germans, the Chinese at least know how to pronounce Huawei correctly…

Huawei reclaimed the lead in China’s smartphone market in Q2 2025. The company captured an 18 percent share, pushing Apple back to fifth place. The iPhone is losing its luster, while Huawei benefits from a strong home market, its own software, and favorable geopolitical tailwinds.

The Details

📊 Market Breakdown: Huawei shipped 12.2 million devices, ahead of Vivo (11.8 million), Oppo (10.7 million), Xiaomi (10.4 million), and Apple (10.1 million).

📉 Apple’s Setback: Despite modest growth (+ 4 percent), Apple continues to lose share. In Dalian, an Apple Store on the mainland has closed for the first time.

🧱 Comeback via Independence: Huawei is rolling out HarmonyOS 5, developing its own chips, and leaning into rising demand for technological sovereignty.

🛒 Growth Fueled by Discounts: Apple adjusted prices and boosted trade-in values—but still couldn’t keep pace with Huawei’s momentum.

Why It Matters

China’s Tech Strategy Pays Off: Huawei’s rise builds a national alternative to US brands—backed by its own OS, supply chain, and political support.

Apple on the Defensive: The era of the iPhone as a status symbol in China is over. Local brands now offer comparable tech, often at lower prices and with faster market adaptations.

Signal to Global Markets: China’s playbook may become a model for other emerging economies.

Background

Huawei’s smartphone business plunged after US sanctions in 2019. Since 2023, the company has fought back with home-grown chips, alternative software, and aggressive product strategies. These latest figures show that Huawei’s battle for survival has turned into a fight for market dominance.

WEBINAR

🧠 The China AI Playbook

Everyone is talking about AI. We’ll show you how it really works.

In just 90 minutes, discover the latest trends and how we used AI to make our processes profitable.

You’ll get:

✅ The latest AI trends from Asia

✅ A real use case from our own work

✅ A 340-page AI report

✅ The asiabits automotive dossier

Bonus: 45 minutes of live Q&A – ask us anything (except for our Netflix passwords).

📅 Only 28 tickets! The first ten attendees get 10% off.

HEAD OF THE DAY

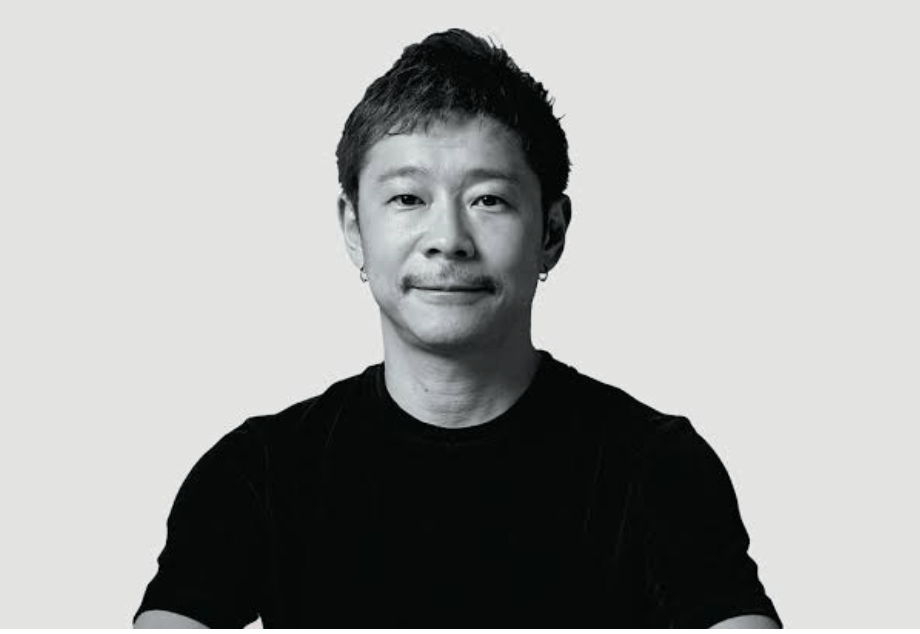

🇯🇵 Yusaku Maezawa

🎨 From CD mailings to fashion maestro: Yusaku Maezawa started in the late ’90s shipping CDs from his living room and launched Zozotown in 2004. In 2019 he sold the site to Yahoo Japan for $2.3 B. He also pours millions into art (a $110 M Basquiat) and is gearing up for a private SpaceX lunar flyby. Born in Chiba, he blends digital retail with artistic flair and daring ambition.

👉 Lesson learned: Start with a minimally viable product (MVP) and test it immediately in the market—just as Maezawa did with his CD mail-order. Today, this is easily achievable with AI and various no-code tools. Use direct customer feedback to build a platform with true product–market fit: personalized product selection, seamless user experience, and reliable logistics. By focusing on user needs and operational excellence, you can turn a niche solution into a market-leading platform.

We’ll show you in our China AI Playbook webinar how you too can quickly build a working prototype. Don’t miss out!

MARKET BIT

💰 Samsung Lands Tesla Mega Deal

It’s not known which drug cocktail Elon Musk is using to celebrate the deal…

Details

📑 Record-Size Contract Manufacturing: Samsung will produce custom AI chips for Tesla through 2033, with a total volume of about $16.5 billion, according to a stock-exchange filing.

📈 Market Reaction: The share price in Seoul jumped over 6 percent and hit its highest level in months. Investors are betting on fresh momentum in Samsung’s previously weak contract-manufacturing business.

🔧 Joint Production in Texas: Tesla’s new AI6 chip design will be manufactured at the Taylor, Texas plant. Elon Musk announced that his team will work directly on the factory floor to boost both quality and output.

⚔️ Pressure on TSMC: The mega-deal brings Samsung closer to the world leader—especially in two-nanometer technology—intensifying the competition for top-end AI chips.

Why It Matters

Predictable Capacity for Samsung: The long-term contract will keep its fabs busy for years and stabilize chip-business revenues.

Technological Edge for Tesla: Proprietary high-performance chips strengthen autonomy and accelerate the path to fully self-driving cars.

Boost for US Industrial Policy: The multi-billion-dollar investment in Texas supports the “Chip USA” agenda, creates high-tech jobs, and fortifies domestic semiconductor infrastructure.

TOP READS

🤖 AI Experts Call for US-China Cooperation: At the World AI Conference in Shanghai, Nobel laureate Geoffrey Hinton proposed establishing international AI safety networks. Leading scientists and business leaders stressed that united efforts can keep the technology under control amid rising risks. Full story.

🚖 Pony AI Launches 24/7 Robotaxi Testing: From now on, the company’s vehicles will operate around the clock in Beijing, Guangzhou, and Shenzhen. They’re collecting extensive data on urban night traffic and, with upgraded technology, plan to deploy a fleet of over 1,000 robotaxis by year’s end. Full story.

🚫 North Korea Rejects Seoul's Outreach: Kim Yo Jong, sister of Kim Jong Un, continues to label South Korea as an "enemy" and dismisses new diplomatic efforts from President Lee Jae Myung. She criticizes South Korea's "blind trust" in the US and joint military exercises. Prospects for improved inter-Korean relations remain bleak. Full story.

OPTIONAL READS

Sri Lanka: BYD uses smart tax strategies and lowers prices to conquer the auto market after an import ban. More on this.

India: Prime Minister Modi secures a $565m credit line to boost infrastructure and defense in the Maldives, strengthening bilateral ties. More on this.

Japan: Tokyo proposes relocating UN offices while the US steps back. More on this.

FORTUNE COOKIE

👙 Bye Bye Beijing Bikini: It’s inevitable. Sooner or later, the cultural icon known as the “Beijing bikini” (see photo) will vanish from Chinese cities.

At temperatures above 104 °F (40 °C), this move serves as an easy way to cool down for many Chinese—but city officials say it “harms the urban landscape” and deem it “uncivilized behavior.”

The ban comes with fines and public campaigns mocking half-naked torsos.

Maybe we can start this trend in Europe or the US? What do you think?

Imprint:

The asiabits editorial team: Michael Broza, Thomas Derksen, Raymond Kwok, Eva Trotno and Cindy Zhang

Asiabits Co., Ltd. Room 413, 4/F, Lucky Centre, 165-171 Wan Chai Road, Wan Chai, Hongkong