- asiabits

- Posts

- 🟠 After Fukushima: Japan restarts nuclear giant

🟠 After Fukushima: Japan restarts nuclear giant

Reading time: 4 min 52 sec

Today’s edition is written by:

Anna, Michael & Thomas

☕️ Good morning friends,

these days unicorns no longer seem like rare mythical creatures, but rather… city pigeons.

There are now 1,569 companies worldwide with unicorn status. 🦄

Do you remember “A million isn’t cool. A billion is.” from The Social Network?

15 years later, the road to a “$1B valuation” in the pitch deck sounds suspiciously easy.

P.S. Listen to our new podcast episode. “How a Shenzhen Founder Got Abu Dhabi Royals as Investors.”

ON A PERSONAL NOTE

Give us 3 minutes of your time, and we’ll give you our 33-page China Insider Guide. Sounds fair?

Join our quick survey. 🤝

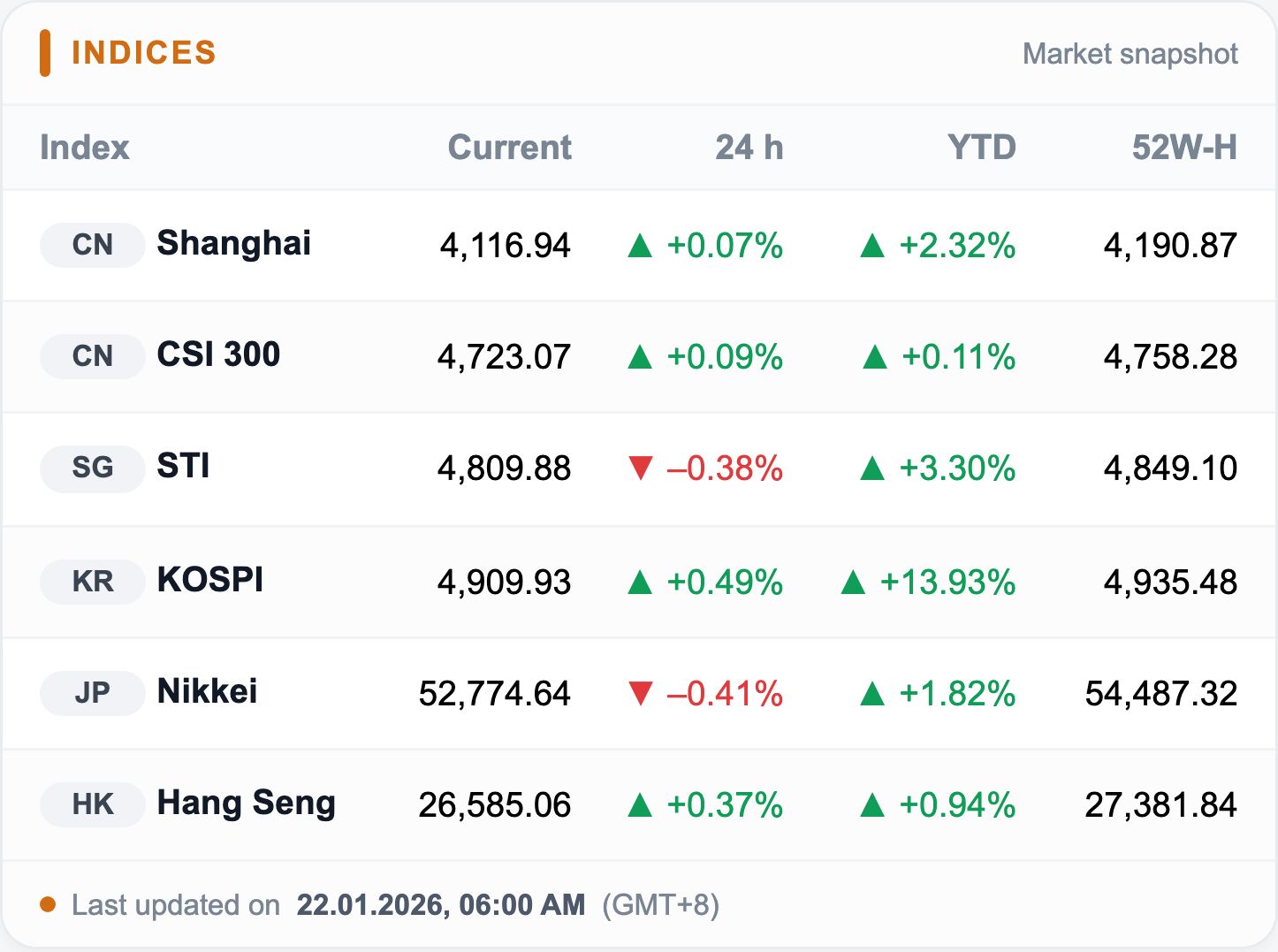

After the Wall Street sell-off, sentiment turns cautious: Trump’s Greenland push and fresh tariff threats are fueling risk concerns. Chip stocks remain relatively resilient across Asia, while banks and industrials slip modestly.

TOP BIT

⚛️ Japan’s Nuclear Comeback: Uranium instead of LNG

After 15 years of shutdown, Tokyo is bringing the world’s largest nuclear power plant back online.

What sounds like energy pragmatism is in fact a geopolitical pivot – away from LNG, toward uranium. And this under the operator TEPCO, the very symbol of the Fukushima disaster.

Details

The Restart: Initially, only Reactor 6 at Kashiwazaki-Kariwa will go online. In the long run, the plant could deliver up to 8.2 gigawatts – enough to power millions of households.

The Fukushima Test: This marks TEPCO’s first reactor restart since the 2011 catastrophe. The move is widely seen as a litmus test for Japan’s entire nuclear industry – and for public trust in the operator.

Safety vs Seismics: The facility sits on an active geological fault line and was hit by a strong earthquake in 2007. TEPCO has since upgraded defenses: a tsunami wall, emergency power systems, and stricter oversight.

Industry over Ideology: The government is not only reviving old reactors but also planning new ones – especially Small Modular Reactors (SMRs) in cooperation with the United States.

Back to nuclear power?

Offshore wind is expanding more slowly than expected, LNG is expensive, and coal is no longer politically viable. At the same time, electricity demand is rising sharply due to data centers, industrial growth, and decarbonization targets.

Nuclear power is now being sold again as a “stability anchor” – backed by the new government and the Seventh Basic Energy Plan:

🟡 Energy mix 2040: Nuclear 20%, Renewables 40–50%, Fossil fuels 30–40%

🟡 Policy shift: No more “phasing down nuclear” – instead active use and expansion

🟡 Triple objective: Energy security, competitiveness and decarbonization, complemented by a focus on hydrogen, ammonia and smart grids

Nuclear power delivers baseload electricity without weather risk and with low direct emissions, helping to stabilize prices, cut import costs and secure climate targets.

Background

After Fukushima, all 54 of Japan’s reactors were shut down. Today, only 33 are still considered operable, and so far just 15 have returned to service.

The restart of Kashiwazaki-Kariwa marks a political turning point: Japan is once again accepting nuclear power as a core pillar of its strategic energy architecture.

📊 All details & data: AlJazeera, StraitsTimes, SCMP, JapanToday

OUR PARTNER

Dashboards Aren’t Direction. You Still Make the Call.

Automation can generate reports, but sound financial leadership still requires human judgment.

The Future of Financial Leadership is a free guide that explores why BELAY Financial Solutions focus on human expertise to help leaders make confident, informed decisions.

NUMBER OF THE DAY

This is the punishment China’s securities watchdog imposed on influencer Jin Yongrong for manipulating stocks.

📉 Followers as exit liquidity: The influencer, with over 1 million followers, bought shares through multiple brokerage accounts, hyped them to his audience on the Xueqiu 雪球 platform, then sold into the surge in demand.

🚫 Profits seized, market ban: From Sept. 2024 to Apr. 2025, he made about $6 million in illegal gains. The profits were confiscated and he was banned from the securities market for three years.

Watch: Beijing is making it clear that “finfluencer alpha” is no longer a grey zone. Buy first, post second, sell last — and you risk serious money.

MARKET BIT

💄 Olive Young & Sephora: From rivals to global K-beauty partners

Korea’s largest beauty retailer CJ Olive Young and Sephora have entered a strategic partnership to scale K-beauty globally.

🤝 From rivalry to alliance: Starting in the second half of the year, curated K-beauty zones will launch online and in selected stores. The rollout begins in the U.S., Canada, Hong Kong, and Southeast Asia, with expansion to the UK, Australia, and the Middle East planned by 2027.

The details

Strategic lever: Olive Young brings assortments, trends, and brands straight from the Korean market. Sephora provides the global infrastructure—more than 3,400 stores across 35 countries—opening international shelf space for small and mid-sized K-beauty brands.

K-boom with entry barriers: Sephora exited South Korea in 2024 after failing to gain traction against Olive Young. Internationally, however, both sides now see significant growth potential together.

Re-entry for Sephora: Direct access to trends at the source—without having to rebuild a local market presence.

Objective: Combine complementary strengths where K-beauty demand exists but scalable access has been limited.

Go-to-market: Integrated campaigns, pop-ups, and cross-promotions. The partnership complements Olive Young’s own expansion, which kicks off with its first U.S. flagship in California.

💋 Sector context

K-beauty has moved from niche to global mainstream. South Korea’s cosmetics exports surpassed $11 billion for the first time in 2025, with the U.S. as the largest single market—ahead of France.

Global retailers struggle in Asia because speed, channels, and consumer trends are driven locally. China shows this starkly: in 2025, around 57% of beauty sales were captured by domestic brands.

Bottom line: To crack Asia, global players need local partners. At the same time, Sephora is exporting Korea’s trend-speed system into global retail scale.

👉🏻 Full Story: The Investor Korea, Forbes, Business of Fashion

ASIABITS CONNECT

🧡 Looking for partners?

Many companies don’t fail in Asia because of a lack of demand, but because they lack local access.

We work daily with local market leaders and partners in China, as well as strong networks across SEA, Japan, and Korea.

🤝 Our focus: Market entry, partner sourcing, and real introductions — not PowerPoint consulting.

Are you actively looking for strategic partners in Asia?Let's talk. |

HEAD OF THE DAY

🇮🇳 Ritesh Agarwal

🏨 The man building India’s hotel empire

Ritesh Agarwal, 31, is the founder and CEO of OYO Hotels, India’s fastest-growing hospitality chain and one of the world’s largest hotel networks. He started the company in 2013 at just 19, with the mission to make affordable, standardized stays available to every traveler.

Why he matters: Agarwal turned a college startup into a global hospitality powerhouse, proving that innovation, speed, and scale can disrupt even the most traditional industries.

Under Agarwal’s leadership, OYO has expanded to 80+ countries and 50,000+ hotels, transforming the budget hospitality market and giving millions access to reliable accommodation.

HIGHLIGHTS

🤖 The first AI rulebook: South Korea will begin enforcing its Artificial Intelligence Act this week, becoming the first country to set safety rules for high-performance AI systems. The law aims to boost domestic AI growth while introducing baseline safeguards, including a new Presidential AI Council and a national AI Safety Institute. Unlike the EU’s use-case approach, Korea regulates only the most advanced models based on technical thresholds and says none currently qualify.

📱 Huawei kicked out of Europe? Brussels wants to force all EU countries to rip Huawei and ZTE out of their mobile networks under a new cybersecurity law, turning years of soft recommendations into binding rules. Capitals would have three years to comply or face court. The plan could go far beyond 5G, potentially shutting Chinese firms out of critical sectors like energy, cloud computing, semiconductors and connected vehicles — a move likely to deepen tensions with Beijing.

💉 Bye bye acne: A Chinese-developed acne vaccine has entered clinical trials, marking a national milestone in treating one of the most common skin conditions. Developed by WestVac BioPharma, the shot targets Cutibacterium acnes by training the immune system to curb inflammation, rather than preventing infection outright. Researchers see it as an alternative to antibiotics and hormonal treatments, with trials now underway to assess safety and immune response.

COUNTRY READS

🇲🇾 Malaysia’s trade hits a record high, with booming electronics exports pushing total commerce past RM3 trillion. More on this.

🇯🇵 Japanese streetwear brand Human Made eyes global expansion, as overseas demand surges following its IPO. More on this.

🇨🇳 Pop Mart rises nearly 10% on first share buyback in two years, showing confidence despite weaker demand. More on this.

✅ Make Turon, one of our favourite Filipino desserts.

✅ Try the king of fruits on your next visit to Southeast-Asia.

✅ Learn China’s history in 60sec.

✅ Consider staying at one of the world's most spectacular tree houses.

✅ Stay up-to-date and follow us on Instagram.

FORTUNE COOKIE

When life tries to blow you away, hold on to the right person! ☂️

MORE ASIABITS

All the latest AI trends from Asia — every Wednesday, exclusively with us.

The Asiabits Podcast on YouTube.

The Asiabits Podcast on Spotify.

CAREER BITS

🌏 Sony Pictures: Business Analyst, Information Technology, Tokyo

🌏 Dyson: Assistant Communications Manager, Shanghai

🌏 Tencent: People Operation Manager - Employee Lifecycle, Shenzhen

🌏 OPPO: Senior Retail Marketing Manager, Dongguan

🌏 Samsung: Assistant Manager, Business Development, Bangkok

🌏 Grab: Associate, Account Management, Hanoi

🌏 SKF Group: Digital Product Information Manager, Bengaluru

🌏 Foxconn: Senior Data Scientist, Taipei

🌏 Hyundai: CRM Executive, Dublin

🌏 Huawei: Junior Project Manager, Prague

YOUR FEEDBACK

How did you like today's briefing? |